Dear Clients:

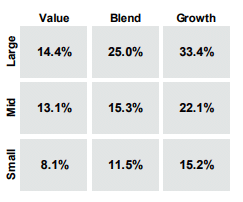

As long-term investors, we don’t focus on and try not to get too hung-up on short-term performance, whether good or not so good. Still, the great news is client equity portfolios produced strong absolute and relative-to-benchmarks performance throughout 2024. As we’ll discuss, this was particularly satisfying given 1) the “average” stock in the S&P 500 underperformed the S&P 500 Index by more than half and 2) “Value” stocks massively underperformed “Growth” stocks across the market-capitalization spectrum, continuing a 20-year drought for “Value” that seems like it will never end (but we think/hope eventually will).

Can you remember how you felt two years ago? Hard to believe now, but it was a very dark time for the U.S. financial markets as the Federal Reserve’s crusade against inflation resulted in a record destruction of wealth. In 2022, U.S. stocks had their worst performance since the depths of the Global Financial Crisis in 2008 (4th worst for the S&P 500 Index since 1945) and worst year for bonds ever.

The “Bear Market” erased almost $13 trillion in market value from stocks, while supposedly “safe,” investment-grade bonds shed almost $3 trillion.

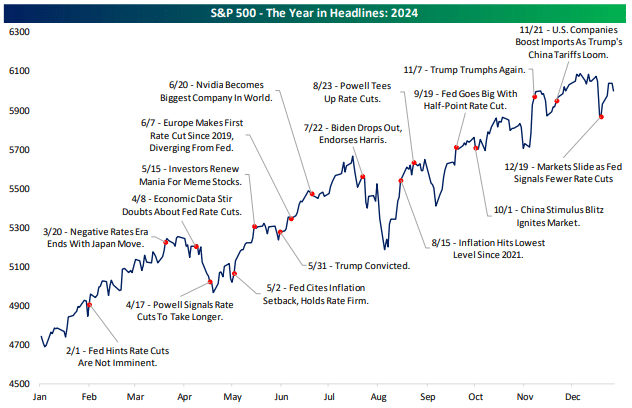

“Bear Markets” (drops of > 20%) and “Corrections” (drops of > 10%) are unpleasant, but normal parts of your investment journey. In fact, according to Crandall-Pierce, since 1900 U.S. stocks have experienced a “Correction” or “Bear Market” every 3.12 years. In difficult times, the hardest thing for long-term investors to do is wait and do nothing. Fast forwarding two years, investors who “waited and did nothing” have been amply rewarded for their fortitude, as the S&P 500 finished 2024 up a whopping 65.4% from its bear market low on October 12, 2022 and closed at an all-time high (ATH) fifty-seven times in 2024.

Indeed, the front-page headline of the December 31, 2024 edition of The Wall Street Journal trumpeted, “Stocks Cap Best Two Years in a Quarter-Century,” as the S&P 500 posted back-to-back annual gains of more than 20% for the first time since 1997 and 1998 (which preceded the bursting of the dot-com bubble in early 2000). What a difference two-years made!

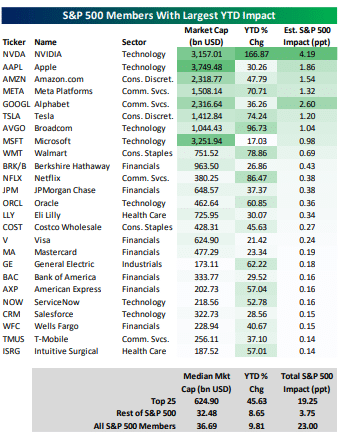

Despite a pause/reversal in the third quarter, the “Magnificent Seven” mega-capitalization technology stocks (Apple, Microsoft, NVIDIA, Alphabet, Amazon, Meta Platforms and Tesla) continued to drive performance of the S&P 500 in 2024. According to Bespoke Investment Group (“Bespoke”), these seven stocks (1.4% of the stocks in the index) contributed more than 50% of the S&P 500’s gain in 2024. Further, as shown in the table below, the 25 largest-capitalization stocks (5% of the stocks in the index) rose an average of 45.6% and accounted for 84% of the gain for the S&P 500. The remaining 475 stocks (95% of the stocks in the index) increased an average of only 8.7% and accounted for only 16% of the S&P 500’s gain.

While investors may define “Value” and “Growth” differently, we’ve always viewed ourselves as “Value” investors, attempting to buy businesses at a discount to our evaluation of their intrinsic worth (based on present and future cash generation). Regardless of the specific definition, as stated above “Value’s” 20-year walk through the performance desert continued in 2024.

Spotlight Stock—MasTec Inc. (NYSE: MTZ)

There seems to be a new “gold rush” every day in the digital age. Over the last two years, it was all about artificial intelligence. Power also became a focus, as demand from electric vehicles and power-hungry data centers pushed our electrical grid to its limits. Semiconductor manufacturers continue to build factories, spurred by the CHIPS Act. Bitcoin mania rises and falls, but continually consumes energy from “mining.” Quantum computing has become a new and growing focus as, as quantum particles called qubits used to perform calculations must be cooled to “absolute zero” (-459.67 degrees Fahrenheit).

All these pursuits require massive amounts of infrastructure for power and data transmission. MasTec has taken on the role of supplying the modern day “picks and shovels” to serve each of these surging markets.

MasTec’s original business was built around oil and gas pipelines. Over time, the company expanded far beyond to include high-voltage transmission lines, data center construction, broadband networks and renewable energy installations. This shift did not happen overnight. A series of savvy acquisitions brought fresh expertise and allowed the company to become more flexible and resilient, regardless of which digital trend dominates headlines.

Power transmission is a major business. Utilities must upgrade existing lines to handle greatly increased demand. MasTec competes for large, multi-year contracts worth up to hundreds of millions of dollars to modernize these grids. These projects call for detailed engineering and skilled crews. MasTec has proven it can manage these massive projects, making it one of the few contractors able to meet this rising need.

Data centers are another important driver. Cloud computing and artificial intelligence rely upon rows of servers requiring a stable power source and extensive site preparation. MasTec connects new facilities to the power grid and ensures the infrastructure can handle large, constant loads. The company neither runs nor owns the data centers, but provides the crucial services that let them grow as digital demands escalate.

MasTec also has a long history of serving the Communications industry, installing cell towers and upgrading equipment for major carriers during the 4G and 5G rollouts. That background has helped MasTec secure fiber projects, especially in rural and underserved regions. Federal and state programs aim to broaden internet access, which means more fiber routes and construction. While wireless continues to evolve, fiber remains a priority for many governments and companies trying to close the connectivity gap.

Renewable energy has also become a significant contributor, as MasTec has won large orders for solar, wind and battery storage projects. MasTec offers a “one-stop” service, handling tasks like site grading, installing turbines or panels and connecting everything to the grid. Even if government incentives for green power shift, solar and wind remain attractive to many buyers. MasTec’s approach appeals to customers looking for a single contractor that can manage both construction and system integration.

By offering core infrastructure services, MasTec stays relevant in a constantly changing marketplace. Whenever new trends emerge—from AI to crypto or from 5G to EV chargers—MasTec can supply the underlying systems that keep them running. The company doesn’t have to guess which single sector will explode next. Instead, it spreads out its bets by constructing the broadband lines, data centers and renewable grids that modern projects rely on.

This model mirrors the old “gold rush” merchants, who sold tools to miners rather than panning for gold themselves. MasTec profits by selling tools to modern “miners,” without having to predict which “miner” will strike “gold.” Every new wave of innovation will need more electricity, stronger networks and faster data processing. We believe MasTec has positioned itself to play a lasting role in the digital gold rush, standing ready to deliver the vital “picks and shovels” for each new frontier.

What Are the “Pros” and “Cons” for 2025?

While we’re glad about 2024 performance, that’s now in the rearview mirror and we have to drive looking forward. The following “Pros” and “Cons” were cited by Bespoke.

“Pros” (Past performance is no guarantee of future results)

- Positive Historical Pattern. Historically, periods like the last 12 months through mid-December 2024 have been followed by positive returns. In the ten periods most correlated to the last 12 months, the S&P 500 was higher six months later all ten times.

- The Economy and Labor Market Remain Healthy.

- Inflation Back Near Pre-Covid Norms. Inflation has not yet reached the Fed’s 2% target, but has cooled materially from peak levels.

“Cons”

- Already Had One of the Best Two-Year Periods on Record. Following prior periods of similar two-year returns since 1930, equity market performance over the next year was below average.

- First Year of the Presidential Cycle. While historical performance during the first year of an administration has been positive, it is the second weakest year of the four-year Presidential cycle. Median performance during the first year of a Republican administration has been even weaker.

- Rich Valuations. The S&P 500’s P/E ratio ranks in the 96th percentile for all periods since 1929.

Predictions/Forecasts for 2025

Just like in 2023 (and almost all years, for that matter), the stock market in 2024 defied the predictions and prognostications of highly-paid Wall Street strategists and other soothsayers and “experts.” We’re big believers it’s impossible to accurately forecast markets and/or the economy, so making predictions is a waste of time. For example, at the end of 2023 the most pessimistic forecast (JP Morgan) had the S&P 500 closing 2024 at 4200, the most optimistic (Yardeni Research) predicted 5400 and the average target was 4861. The S&P 500 closed 2004 at 5881.63, 21% above the average target and 8.9% above even the most bullish prediction. Last year was not an outlier. In fact, Bespoke determined “consensus” annual forecasts missed by an average of 14.2 percentage points going back to 2000.

In spite of their dismal record, “experts” predict and many investors pay attention. Don’t be one of them! Heeding “expert” predictions can be extremely dangerous and costly; such predictions should be considered “for entertainment purposes only.”

That said, we do have a “non-forecast” for 2025, which is nearly identical to our previous “non-forecasts.”

- The economy/financial markets will do something that surprises us (and the “experts”).

- The financial media will enrich themselves by emotionalizing headlines and short-term market moves to entice you to click and tune in. It’s nothing more than click bait.

- Investors who tune into the news and evaluate their performance often will experience more stress and anxiety than those that don’t.

- Investing in the stock market will be unpleasant at times. Historically, the stock market goes down roughly half the time on a daily basis.

- Investors that move to cash, waiting for a “better time,” will suffer significant uncertainty and anxiety about when and how to get back in.

- Your investment decisions and reactions to market events will have a significant impact on your personal investment return.

- You will be tempted to change your investment strategy based on market performance, expert forecasts and/or your personal beliefs about the future.

Conviction, patience, and discipline are virtues every investor should develop. Warren Buffett has described successful investing as “simple, but not easy.” As your advisor, one of our most important roles is helping you ignore the noise and focus on what really matters to your financial success.

We wish you a prosperous, fulfilling, and happy 2025. Thank you for allowing us to be your trusted partner along your investment journey.

Regards,

Kirr, Marbach & Company, LLC

Past performance is not a guarantee of future results.

The S&P 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This index cannot be invested in directly.

The opinions expressed in this letter are those of Kirr, Marbach & Company, LLC as of the date the letter was published. The information provided in this letter is not intended to be a forecast of future events, a guarantee of future results and do not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular stock or other investment.