Dear Clients:

The S&P 500 closed at an all-time high (ATH) on February 19 (just after Valentine’s Day), its 60th ATH since the beginning of 2024. Investors’ love affair with stocks seemed to be in full bloom. Alas, heartache was right around the corner, as the S&P 500 plunged into “correction” territory (down > 10%) on March 13 (just 16 trading days later) and briefly entered a tariff-induced “bear market” (down > 20%) this morning.

Uncertainty has skyrocketed and business and consumer confidence have plummeted. The front page headline of the December 31, 2024 edition of The Wall Street Journal (WSJ) trumpeted, “Stocks Cap Best Two Years in a Quarter-Century,” as the S&P 500 stacked back-to-back annual gains of more than 20% for the first time since 1997 and 1998. Fast forwarding three months, the WSJ moaned “U.S. Stocks Post Worst Quarter Since 2022 on Threat of Trade War.” It got even worse after “Liberation Day” (more below), with the WSJ headline blaring “Trump’s Tariffs Wipe Out Over $6 Trillion on Wall Street in Epic Two-Day Rout,” as U.S. stocks had their worst week since the March 2020 Covid debacle.

We’ve been through many significant market declines over our firm’s almost 50 years. While tariffs and a possible trade war are new, surprises and economic shocks are not new to us. No matter the cause of the shock, our response is always the same – we seek opportunity in others’ fear and are looking to pick up some bargains.

President Trump Announces Massive Tariffs on “Liberation Day” (April 2, 2025)

On April 3, 1948, President Harry Truman signed the Economic Assistance Act, better known as the Marshall Plan, (Secretary of State George Marshall proposed the U.S. provide assistance to restore the economic infrastructure of post-World War II Europe) into law. Truman said, “the signing of this act is a momentous occasion in the world’s quest for enduring peace.”

The benefits of the Marshall Plan for the U.S. were 1) rebuilding markets for American goods, 2) creating reliable trading partners and 3) development of stable democratic governments in Western Europe.

The seeds of the second great age of globalization were sown with the fall of the Berlin Wall on November 9, 1989. With the end of the Cold War, the world benefitted from a global “peace dividend” giving countries an opportunity to look far beyond traditional borders.

In a pre-Thanksgiving radio address (on why we should be thankful for trade), President Ronald Reagan said, “our peaceful trading partners are not our enemies; they are our allies. We should beware of the demagogs who are ready to declare a trade war against our friends—weakening our economy, our national security, and the entire free world—all while cynically waving the American flag. The expansion of the international economy is not a foreign invasion; it is an American triumph, one we worked hard to achieve, and something central to our vision of a peaceful and prosperous world of freedom.”

It wasn’t perfect. Many countries imposed tariffs or other barriers on U.S. exports, but the U.S. economy still prospered and was universally envied. Being recognized as the undisputed leader of the free world resulted in extraordinary privileges. The U.S. dollar has been the world’s dominant “reserve currency,” a status earned by being backed by a strong economy and stable political environment. Importantly, our trading partners were willing to fund our government’s ever-increasing budget deficits by investing export dollars in U.S. government debt.

On “Liberation Day” (April 2, 2025—ironically 76 years and 364 days after Truman signed the Marshall Plan), President Trump announced a new trade regime where the U.S. would focus on its own best interests.

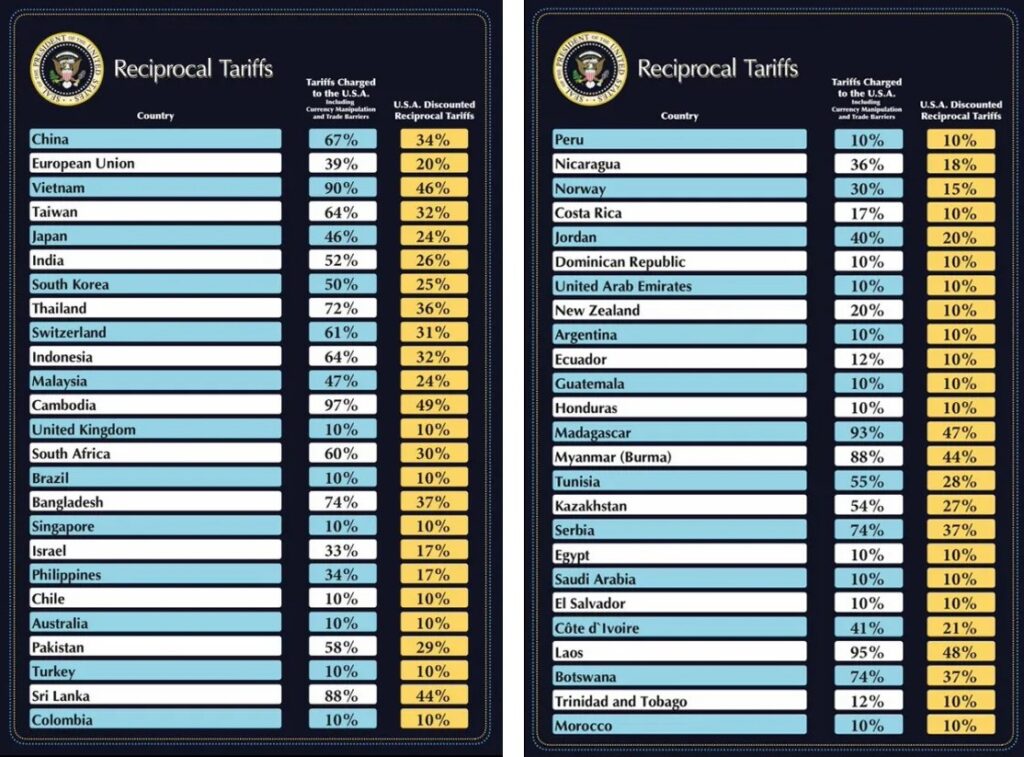

The magnitude of the “reciprocal” tariffs was stunning and the underlying logic puzzling. The U.S. imports and exports goods (physical products) and services, but these tariffs considered only goods. The U.S. imported $439 billion of Chinese goods in 2024 and exported $144 billion, leading to a goods-trade deficit of $295 billion. According to the Office of the U.S. Trade Representative, the entire $295 billion trade deficit can be attributed to Chinese tariffs or other non-tariff trade barriers, a dubious assumption. The “reciprocal” tariff formula took the $295 billion deficit and divided it by $439 billion of Chinese goods imported, to arrive at a “reciprocal” tariff rate of 67% (“kindly” discounted by 50% to arrive at the announced tariff rate of 34%).

“Reciprocal” tariff is actually a misnomer, as the calculation simplistically considered only the amount of the deficit, not actual Chinese tariffs. According to President Trump, any trade deficit is akin to “losing,” so there’s no need to acknowledge a country can have an economic “comparative advantage” enabling it to produce a certain good or service at a lower cost than the U.S.. According to economic theory, when trading partners are free to produce the goods each does best, both partners benefit.

The conservative The Wall Street Journal (WSJ) wrote in an editorial “Trump’s New Protectionist Age—Blowing up the world trading system has consequences that the President isn’t advertising,” referred to the tariffs unveiled on imports from allies (24% on Japan, 20% on the European Union) and adversaries (34% on China) alike as “another large step toward a new old era of trade protectionism. Assuming the policy sticks—and we hope it doesn’t—the effort amounts to an attempt to remake the U.S. economy and the world trading system.”

The WSJ cited “consequences already emerging in this new protectionist age:”

- New economic risks and uncertainty. Will our trading partners try to negotiate to reduce tariffs, or will there be widespread retaliation (increased tariffs on U.S. exports) leading to a devastating trade war?

- Another risk lurking is the U.S. government is dependent on debtholders “rolling over” maturing bonds by buying newly issued bonds. China holds about $759 billion of U.S. government debt, making it the second largest foreign holder (behind Japan). If China refuses to buy new bonds, who will fill the void and at what price?

- Harm to American exports. 41% of S&P 500 firms’ revenues come from abroad.

- The end of U.S. economic leadership. “U.S. leadership and the decision to spread free trade produced seven decades of mostly rising prosperity at home and abroad.”

- A major opportunity for China. U.S. tariffs will give China the opening to use its giant market to woo American allies into its economic and geopolitical orbit.

- In closing, “this is far from a comprehensive list, but we offer them as food for thought as Mr. Trump builds his new protectionist world. Remaking the world economy has large consequences, and they may not all add up to what Mr. Trump advertises as a new ‘golden age.’”

We didn’t have to wait long for China’s response, as hours later it announced its own 34% “reciprocal” tariff on all American imports. The response from investors was swift and severe, with the S&P 500 plunging 10.5% over the following two days, vaporizing more than $6 trillion in wealth.

Thoughts To Get You Through Uncertain Times (Like Now)

Because uncertainty is uncomfortable and stressful, it’s human nature to seek certainty in “expert” market and economic forecasts of how a possible/likely global trade war will lead to stagflation (a softening economy coupled with rising inflation) and further weakening of stocks. Unfortunately, the financial media was built to satiate this appetite as an “all-you-can-eat” buffet of forecasts offered by a veritable army of financial “experts,” pundits, carnival barkers and soothsayers. Forecasters know fear sells and their forecasts are “click bait” to be monetized. Competing for eyeballs, an outlandish, but seemingly well-reasoned doomsday prediction is catnip to the fearful.

Unfortunately, “certainty” is both an impossibility and a dangerous illusion. According to Howard Marks of Oaktree Capital Management in “The Illusion of Knowledge,” the trouble with trying to model the economy or financial markets is they are incredibly complex, with literally millions of moving pieces which are both interdependent and can change in importance depending on the mood of the day. Marks believes it’s better to acknowledge “you can’t know the future; you don’t have to know the future; and the proper goal is to do the best possible job of investing in the absence of knowledge.” Navigate, don’t predict.

According to Warren Buffett, in addition to economists being lousy forecasters, “something different happens all the time. And that’s one reason economic predictions just don’t enter into our decisions. Charlie Munger – my partner – and I in 54 years now never made a decision based on an economic prediction. We make business predictions about what individual businesses will do over time, and we compare that to what we had to pay for them.

“But we have never said ‘yes’ to something because we thought the economy was going to do well in the next year or two years. And we have never said ‘no’ to anything because we were right in the middle of a panic. There are so many variables. I mean, in the hard sciences, you know that if an apple falls from a tree, that it isn’t going to change over the centuries because of anything or political developments or 400 other variables that go in. But when you get into economics, there are so many variables, and the truth is, you’ve got to expect good times and bad times in business.”

Stocks aren’t ticker symbols, but represent business ownership sliced into small pieces. The key is stock prices can be extraordinarily volatile (like recently), but the value of the underlying business is much less so. Like Buffett, we try to buy “great businesses with great managers,” who will be able to succeed during difficult times just as they would during good times. “We’re going to have good years, bad years, in-between years and maybe a disastrous year some year,” he said. “We care a lot about the price. We do not care about the next 12 months.”

Crises happen. We try to invest in businesses that have stood the test of time and navigated economic, political and financial market calamities. Today’s list of risks includes tariffs/trade war, inflation, recession and the ever-present “black swan” event. Good companies adapt, so will these matter to the value of the business in five or twenty years?

Speaking of “black swans” (extremely low probability, but high impact events), it’s hard to believe February 19 also marked the 5-year anniversary of the start of the most rapid market meltdown in history. With Covid paralyzing economic activity, between February 19 to March 23, 2020 (23 trading days), the S&P 500 dropped a nauseating 33.9%. If you got scared out of stocks, you would have missed the 17.6% surge from March 24-26, the biggest three-day advance in more than 80 years. Clearly, market timing is a fool’s errand.

Buffett also understands extreme short-term volatility is not only normal, it’s necessary for generating great long-term returns.

In a 2001 interview in Fortune, Buffett said, “This is the one thing I can never understand. To refer to a personal taste of mine, I’m going to be buying hamburgers the rest of my life. When hamburgers go down in price, we sing the ‘Hallelujah Chorus’ in the Buffett household. When hamburgers go up, we weep.”

“For most people, it’s the same way with everything in life they will be buying—except stocks. When stocks go down and you can get more for your money, people don’t like them anymore.”

Further, as Buffett said in Berkshire-Hathaway’s 2013 annual shareholder letter, “it should be an enormous advantage for investors in stocks to have those wildly fluctuating valuations placed on their holdings – and for some investors, it is. After all, if a moody fellow with a farm bordering my property yelled out a price every day to me at which he would either buy my farm or sell me his – and those prices varied widely over short periods of time depending on his mental state – how in the world could I be other than benefited by his erratic behavior? If his daily shout-out was ridiculously low, and I had some spare cash, I would buy his farm. If the number he yelled was absurdly high, I could either sell to him or just go on farming.

“Owners of stocks, however, too often let the capricious and often irrational behavior of their fellow owners cause them to behave irrationally as well. Because there is so much chatter about markets, the economy, interest rates, price behavior of stocks, etc., some investors believe it is important to listen to pundits – and, worse yet, important to consider acting upon their comments.

“Those people who can sit quietly for decades when they own a farm or apartment house too often become frenetic when they are exposed to a stream of stock quotations and accompanying commentators delivering an implied message of “Don’t just sit there, do something.””

“For these investors, liquidity is transformed from the unqualified benefit it should be to a curse. A “flash crash” or some other extreme market fluctuation can’t hurt an investor any more than an erratic and mouthy neighbor can hurt my farm investment. Indeed, tumbling markets can be helpful to the true investor if he has cash available when prices get far out of line with values. A climate of fear is your friend when investing; a euphoric world is your enemy.”

Focus on what you can control and try not to fret about what you can’t. Extreme short-term volatility can be a gift to long-term investors, if you let it. You control how much volatility you experience. If market fluctuations and negative forecasts affect you (as it does most people), the best advice during these periods is to simply not look. The market will do what it does. As Buffett advised, “Games are won by players who focus on the playing field—not by those whose eyes are glued to the scoreboard. If you can enjoy Saturdays and Sundays without looking at stock prices, give it a try on weekdays.”

Kirr, Marbach’s 50th Anniversary—May 1, 2025

Thanks solely to the trust and confidence our clients have placed in us, Kirr, Marbach will celebrate our 50th Anniversary on May 1, 2025. We’re excited to have Mitch Daniels join Mark Foster, CFA, KM’s Chief Investment Officer for a “fireside chat.” Before he was Indiana governor and Purdue University president, Daniels was Director of the White House Office of Management and Budget under George W. Bush. He is also Co-Chair of the Committee for a Responsible Federal Budget, so his thoughts on the state of our government’s finances are sure to be insightful and timely.

Daniels has said, “in our nation, in our time, the friends of freedom have an assignment, as great as those of the 1860s, or the 1940s, or the long twilight of the Cold War. As in those days, the American project is menaced by a survival-level threat. We face an enemy, lethal to liberty, and even more implacable than those America has defeated before. We cannot deter it; there is no countervailing danger we can pose. We cannot negotiate with it, any more than with an iceberg or a Great White.

“I refer, of course, to the debts our nation has amassed for itself over decades of indulgence. It is the new Red Menace, this time consisting of ink. We can debate its origins endlessly and search for villains on ideological grounds, but the reality is pure arithmetic. No enterprise, small or large, public or private, can remain self-governing, let alone successful, so deeply in hock to others as we are about to be.”

Interestingly, he said that in 2011, when our national debt was “only” $9.5 trillion. It currently stands at $36.2 trillion. It should be an interesting “chat!”

Regulatory Update

Kirr, Marbach & Company, LLC (KM) is registered with the U.S. Securities and Exchange Commission (“SEC”), which requires advisers to file Forms ADV-Part 1, Part 2A (“Brochure”), Part 2B (“Brochure Supplements”) and Part 3 (“Form CRS-Client Relationship Summary) electronically on the Investment Adviser Registration Depository (www.iard.com). KM filed its annual updating amendments to its Forms ADV-Parts 1, 2A and 2B on March 24, 2025.

Form ADV-Part 2A is a narrative disclosure of an adviser’s business, written in “plain English.” The SEC mandated the headings, specific topics to be covered and the order of presentation.

If you would like a printed copy of KM’s ADV-Part 2A “Brochure” (or ADV-Part 1, Part 2B or Part 3), please contact Matt Kirr, Director of Client Service (matt@kirrmar.com), Zach Greiner, CFP, Director of Client Service (zach@kirrmar.com) or Maggie Kamman, CMA, CFP, Director of Operations/Fixed Income Portfolio Manager (maggie@kirrmar.com) at 812-376-9444 or 800-808-9444 and they’ll be happy to mail to you. Alternatively, you can find KM’s ADV-Part 2A and Part 3 posted on our website www.kirrmar.com under About Us/Regulatory Filings.

Regards,

Kirr, Marbach & Company, LLC

Past performance is not a guarantee of future results.

The S&P 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This index cannot be invested in directly.