Dear Clients:

It was a topsy-turvy first quarter of 2023. Following a dismal 2022, stocks sprinted out of the starting gate in January, as hope sprung eternal we had seen “peak inflation” and the end of rate hikes (and perhaps even rate cuts) by the Federal Reserve (“Fed”) was on the horizon. Stronger than expected economic readings in February dashed those hopes and investors were subject to a full-blown banking crisis in March, as Silvergate Bank, Silicon Valley Bank and Signature Bank all failed and threatened to take the regional bank sector down with them. The contagion threatened to go global and Swiss authorities were forced to arrange a hasty “shotgun wedding” between behemoths UBS and Credit Suisse.

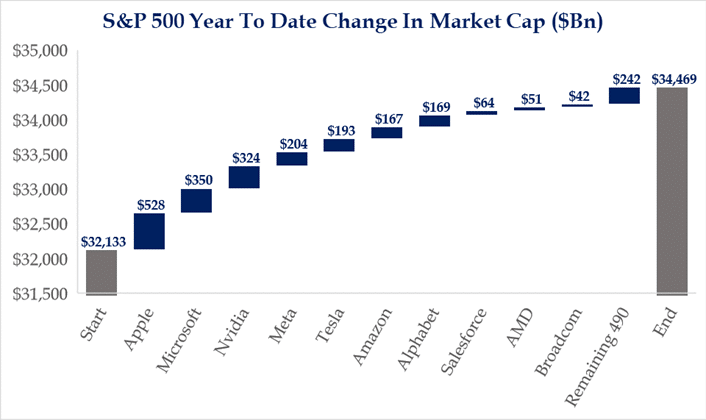

Given these headwinds, it seems somewhat miraculous stocks still managed to post a very respectable gain for the quarter, with the S&P 500 generating a total return of 7.5%. Digging into the underlying performance, the S&P 500’s rally is less rosy. Strategas Research Partners calculated ten big technology stocks accounted for 90% of the gain ($2.094 trillion of the $2.336 trillion increase in the S&P 500’s market capitalization). Fortunately, client portfolios own two of the ten. While Financials declined -5.3% and Energy lost -4.9%, the large-cap technology Nasdaq 100 soared 20.7% (but was still down 10.8% over the last 12-months). Because the advance was extremely narrow, active managers (like us) faced a stiff challenge.

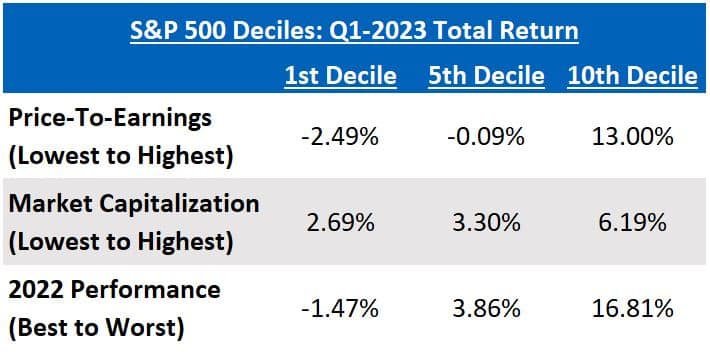

Not only was the market’s advance very narrow, it skewed strongly towards the most expensive stocks (Growth outperformed Value, a reversal from 2022), the largest capitalization stocks and worst performing stocks of 2022. Bespoke Investment Group ranked the stocks in the S&P 500 based on each of these “factors” and examined first quarter performance for each 50-stock decile (10 deciles x 50 stocks = 500). Given the narrow nature of the advance and fact all three of these “factors” weighed significantly against client portfolios, we’re overall pleased with performance.

Fed Policy and the Economy

Way back in June of 2020 the U.S. economy was still very much in the grips of the pandemic. Backed by the work and expertise of its 400 PhD economists, Fed officials confidently predicted that by 2022 the U.S. would still be facing 5.5% unemployment and inflation would be running at 1.7%, below its target of 2%. Further, Fed officials expected to keep interest rates close to 0% through the end of 2022. As Fed Chair Jerome Powell famously stated at the time, “we’re not even thinking about thinking about raising rates.” Think about that!

Fast forward and the CPI (Consumer Price Index) peaked at a 40-year high of 9.1% in June of 2022 and unemployment has been running at 50-year lows, around 3.5%. In March of 2022, the Fed slammed on the brakes on its “accommodative” monetary policy and abruptly reversed course to “restrictive,” rapidly increasing short-term interest rates from essentially 0% at the start of 2022 to 4.5% at the end of 2022 (currently 5%), the most aggressive cycle of rate increases since the early 1980s. During this campaign, Fed officials have 1) made it clear slaying inflation if their top priority and 2) expressed confidence they can achieve this without putting the economy through the windshield (tell that to Silicon Valley Bank—more later).

Several economic indicators we look at show the economy is slowing. The illustration below shows the Conference Board Leading Economic Index (LEI—comprised of ten components) has rolled over. The LEI fell by 0.3% in February (most recent reading), its eleventh consecutive monthly decline. An inverted yield curve occurs when short-term U.S. Treasury yields exceed long-term yields, indicating investors think the economy will be weaker and interest rates lower in the future. The yield curve has now been inverted for four consecutive quarters, with the gap between the two-year and ten-year yields of 1.07% on March 8 the biggest inversion since 1981. Since an inversion has preceded every recent recession, many investors view an inversion as a precursor to a recession. However, not every inversion has been a harbinger of recession. Every salmon is a fish, but not every fish is a salmon.

The National Bureau of Economic Research (NBER) is the authority determining the start and end of U.S. recessions, defined as a “significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales.” The NBER’s pronouncements are based on both a “squishy” definition and backward-looking data, so we would not be surprised if it turns out we’re already in a recession.

There are a million factors that impact the economy, many of which are dependent on other factors. This makes the economy impossible to predict with any accuracy, but people like the 400 PhDs at the Fed still try! That doesn’t give us a whole lot of confidence in their predictions.

SVB’s collapse illustrates fragility of banking’s “confidence game”

March 15 is the “Ides of March,” but it came about a week early for Silicon Valley Bank (SVB) and CEO Greg Becker. Here’s the timeline:

Monday, March 6, 2023

SVB’s stock (SIVB) closes at $385.19, giving it a market capitalization of more than $15 billion.

Tuesday, March 7

CEO Becker makes presentation to institutional investors at Morgan Stanley’s Technology, Media and Telecom Conference in San Francisco, telling the audience the future of the technology industry and SVB’s place in it looks as bright as ever.

SIVB closes at $367.29.

Wednesday, March 8

SIVB closes at $369.50.

After the market close, SVB announces plan to shore-up its finances by selling its entire $21 billion “Available for Sale” (AFS) portfolio (realizing an after-tax loss of $1.8 Billion) and issuing $2.25 Billion in new securities.

Thursday, March 9

On a hastily arranged conference call, CEO Becker assures its largest customers SVB’s financial condition is fine and pleads with them to stay loyal. Becker discovers the age-old truth that the more you tell people everything is fine, the less likely they are to believe everything is fine. Customers respond by withdrawing $42 billion in deposits.

SIVB closes at $146.27.

Friday, March 10

The California Department of Financial Protection and Innovation (DFPI) announces it has taken possession of Silicon Valley Bank, citing inadequate liquidity and insolvency. The DFPI appointed the Federal Deposit Insurance Corporation (FDIC) as receiver of Silicon Valley Bank.

SIVB worth $0.

A bank takes money from depositors, who are paid interest for delaying spending. The bank then lends these funds to borrowers, who pay interest for accelerating spending. The bank profits on the spread.

Sounds simple enough, but the recent collapse of Silicon Valley Bank (SVB) and others proves banking is tricky. Deposits are liabilities to the bank, while loans are assets. The danger is the mis-match between the short-term nature of deposits versus the long-term nature of loans. Depositors can demand their funds be returned immediately, while loan repayments typically stretch for multiple years.

What was true for the Bailey Bros. Building & Loan in “It’s a Wonderful Life” still rings true for J.P. Morgan Chase today; if too many depositors demand their money back at the same time (a bank “run”), you can’t pay them all and the bank fails.

Regulators seized Silicon Valley Bank (SVB) on Friday, March 10 (ironically coinciding with the 15-year anniversary of the collapse of Bear Stearns, the unofficial start of the Global Financial Crisis), citing “inadequate liquidity and insolvency.”

While the end came quickly for SVB, the seeds of its destruction were sown years before. The technology start-up ecosystem in California is dominated by an exclusive “club” of venture capital (VC)/private equity (PE) firms led by Stanford/Ivy League-educated masters of the universe.

CEO Greg Becker (who grew up on a farm in Indiana and received a Business degree from Indiana University) desperately wanted SVB to become a member of this elite club. He was wildly successful in making SVB the “one-stop-shop” bank for VC/PE firms, the start-ups they funded and their founders. SVB understood and welcomed money-losing “disruptors” and their cash-poor founders when bigger, traditional banks shunned them. For this, they were required to keep all of their deposits with SVB.

The Federal Reserve (Fed) slashed short-term interest rates to 0% at the start of the pandemic, unleashing a flood of liquidity that made it to VC/PE firms, who competed to invest the funds with start-ups, much of which found its way to SVB. Indeed, SVB’s deposits almost doubled, from about $102 billion at the end of 2020 to $189 billion a year later.

With short-term rates near 0%, SVB decided it needed to pick-up yield by redeploying this torrent of deposits into longer-term U.S. Treasury and agency-backed mortgage bonds.

Bond owners are subject to credit risk (the risk the bond issuer doesn’t pay you back) and interest rate risk. When interest rates rise, prices of existing bonds fall. Conversely, when rates decline, existing bonds go up in price. Picture a teeter-totter with rates on one end and bond prices on the other.

Persistently high inflation caused the Fed to abandon its zero- interest rate policy and aggressively hike short-term rates nine times over the past year to its current level of 4.75%-5.00%, crushing prices on even the “safest” (from a credit risk perspective) bonds. Indeed, the Bloomberg U.S. Aggregate Bond Index lost a record 13% in 2022, dwarfing the prior record loss of 3% in 1994.

This caused the combined unrealized losses in SVB’s “available for sale” (AFS–bonds they might sell prior to maturity) and “hold to maturity” portfolios to explode from $1.7 billion at the end of 2021 to a whopping $17.7 billion a year later, an amount that would completely wipeout SVB’s capital if those bonds had to be sold.

With the “free money” spigot suddenly shut off, SVB’s cash-burning customers started withdrawing deposits at twice the prior rate, leading to a severe liquidity crunch. Moody’s informed SVB in February it planned to downgrade SVB’s credit rating. SVB turned to Goldman Sachs for advice and announced late on March 8 it had 1) sold its entire $21 billion AFS portfolio (to Goldman, coincidentally), realizing a loss of $1.8 billion and 2) a plan (prayer?) to issue $2.25 billion in new SVB securities.

The announcement was meant to reassure customers, but panic ensued instead. Becker pleaded with fellow club members to stay loyal, but they responded like Caesar’s “friend” Brutus might have by withdrawing $42 billion in deposits the next day, dooming the bank. Unlike during the time of It’s a Wonderful Life, depositors today don’t gather in and get their information from the lobby of the bank. They get the truth or fiction from social media or group chats. Similarly, they don’t wait in line at the teller window. They can withdraw their deposits with a couple clicks on the banking app on their smartphone. That’s one reason George Bailey and the building and loan survived the day and Becker and SVB didn’t.

Becker received $9.9 million in compensation for 2022 and sold $3.6 million of SVB stock on February 27. SVB’s prior Chief Risk Officer departed abruptly last April with over $7.1 million and wasn’t replaced for eight months. The independent Chair of SVB’s board of directors, charged with overseeing management, was paid almost $500,000 in 2022. KPMG was SVB’s independent auditor and gave SVB a “clean bill of health” on February 24.

The San Francisco Fed was SVB’s primary regulator and apparently became alarmed at SVB’s breakneck growth, exposure to rising interest rates and fact an astounding 94% of SVB’s deposits (about $152 billion) were above the FDIC’s $250,000/account insurance limit, making it vulnerable to a run. Still, nothing changed. Coincidentally, Becker was a member of the board of directors of the San Francisco Fed from 2019 until March 10.

In the Global Financial Crisis of 2008, banks blew themselves up with subprime mortgages and an alphabet soup of derivative products. Fifteen years later, Silicon Valley Bank blew itself up with super-prime U.S. Treasury securities. Unfortunately, SVB was not an outlier. The FDIC reported banks were sitting on about $620 billion of unrealized losses in their AFS/HTM portfolios at the end of 2022

Yes, your bank deposits are (probably) safe. The Federal Deposit Insurance Corporation (FDIC) insures bank deposits up to $250,000 per depositor, per insured bank, for each ownership category. A couple can generally structure deposits into two individual accounts and a joint account, for a possible combined insured limit of $1 million. Accounts at federally insured credit unions have protection provided by the National Credit Union Share Insurance Fund (NCUSIF).

To stave-off panic for the banking system as a whole, the government elected to guarantee all deposits at SVB (and Signature Bank, which was also seized), even those above the FDIC limit. This is a “fluid” situation, but we won’t be surprised if the government eventually ends up guaranteeing all deposits, regardless of size. While this is what the Biden administration has implied, there is not yet an explicit guarantee. Until then, if you utilize a bank “sweep” product, that amount is a liability on the bank’s balance sheet and subject to insurance limits. However, if you instead utilize a money market fund investing in short-term U.S. Treasury securities, for example, that amount is not on the bank’s balance sheet and has no credit risk.

The Fed also announced the creation of a new Bank Term Funding Program (BTFP), which would enable banks and credit unions to borrow up to the full face amount of U.S. Treasury and agency mortgage-backed securities. So, if a bank bought a $1,000 U.S. Treasury bond for $1,000 and the market value had fallen to $800 because of rising interest rates, it can use the bond as collateral to borrow $1,000 from the Fed (i.e. it doesn’t have to sell the bond for $800 and realize a loss of $200). Ironically, if the BTFP had been in place the first week of March, SVB probably wouldn’t have failed.

Banks and the banking system make it to tomorrow by making sure depositors never all want their money back at the same time. This state of happiness is dependent on an apparatus built on strong management, effective regulation and supervision and government insurance, all held together by a gossamer thin thread called “confidence.” That thread is fraying and will be difficult and expensive to repair. The result will likely be a more stringent regulatory regime and higher bank capital requirements, leading to bank credit becoming both scarce and more costly, a negative for economic growth.

Cash earning 4% is nice for now, but it’s NOT an investment

As our good friend Jay Mooreland, CFP of the Behavioral Finance Network says, moving to Cash during uncertain times is nothing more than trading potential long-term growth for temporary relief from negative news and stock price fluctuations. It is not investing.

Investing is owning securities for the long-term with recognition the capital markets have always been uncertain and experienced fluctuation. We never make predictions, especially in writing, but are pretty sure the possible breaching of the U.S. debt ceiling will be in the headlines before too long. Investors enter the “game” understanding uncertainty and temporary negative returns are the price one must pay to participate in the long-term wealth generating power of capital markets.

In other words, you’ll likely never lose money in Cash, but you’ll never achieve your long-term investment goals, either.

Summary

We presented our (Non-) Forecast For 2023 in our January client letter. The “out of the blue” banking crisis in March reinforced a couple important points:

- The economy/market will do something that surprises us (and the experts). In hindsight we’ll wonder how we didn’t see it.

- The financial media will emotionalize headlines and short-term market moves to entice you to tune in—so they can achieve better ratings.

- Conviction, patience and discipline are virtues every investor should develop. They aren’t easy, yet they are essential for your success. As your adviser, one of our most important roles is helping you ignore the noise and focus on what really matters to your financial success.

Regulatory Update

Kirr, Marbach & Company, LLC (KM) is registered with the U.S. Securities and Exchange Commission (“SEC”), which requires advisers to file Forms ADV-Part 1, Part 2A (“Brochure”), Part 2B (“Brochure Supplements”) and Part 3 (“Form CRS-Client Relationship Summary) electronically on the Investment Adviser Registration Depository (www.iard.com). KM filed its annual updating amendments to its Forms ADV-Parts 1, 2A and 2B on March 24, 2023.

Form ADV-Part 2A is a narrative disclosure of an adviser’s business, written in “plain English.” The SEC mandated the headings, specific topics to be covered and the order of presentation.

If you would like a printed copy of KM’s ADV-Part 2A “Brochure” (or ADV-Part 1, Part 2B or Part 3), please contact Matt Kirr, Director of Client Service ([email protected]), Zach Greiner, CFP, Associate Director of Client Service ([email protected]) or Maggie Kamman, CFP, Associate Director of Client Service ([email protected]) at 812-376-9444 or 800-808-9444 and they’ll be happy to mail to you. Alternatively, you can find KM’s ADV-Part 2A and Part 3 posted on our website www.kirrmar.com under About Us/Regulatory Filings.

Regards,

Kirr, Marbach & Company, LLC

Past performance is not a guarantee of future results.

The S&P 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This index cannot be invested in directly.