Don’t panic over partisan firestorm, market plunge

Mickey Kim / March 21, 2025

The S&P 500 reached an all-time high (ATH) on February 19. Two days later, my column “Are stocks in a ‘bubble’ after two spectacular years?” was published. We won’t know the answer for many months down the road, but the S&P 500 plunged a gut wrenching 9.3% over the next 14 trading days.

Sentiment has reversed. The front page headline of the December 31, 2024 edition of The Wall Street Journal (WSJ) trumpeted, “Stocks Cap Best Two Years in a Quarter-Century,” as the S&P 500 stacked back-to-back annual gains of more than 20% for the first time since 1997 and 1998. Fast forwarding to March 10, 2025, the WSJ moaned “Nasdaq Suffers Worst Day Since 2022; Investors Weigh Possible Recession.”

Stocks rallied on President Trump’s re-election on investor optimism campaign promises of lower taxes and relaxed regulation would unleash “animal spirits,” leading to higher economic growth and corporate profitability. As is often the case (applies to both parties), the post-election reality has been messier. In particular, the constant cycle of trade war escalation/de-escalation has caused confusion and uncertainty, leading to diminished confidence for businesses, consumers and investors.

Ironically, the pain has been most acute for the stars of the 2023-2024 advance. The “Magnificent 7” mega-capitalization technology stocks are 1.4% of the stocks in the S&P 500 (7/500), but have an index-weighting of about 30% and accounted for more than half of the gain for the S&P 500 in 2024. Nvidia had a total return for 2023-2024 of 820%, but was down 22% in the 14 trading days since February 19, Meta Platforms (388%/-14%), Tesla (228%/-36%), Amazon (161%/-13%), Google (115%/-11%), Apple (95%/-10%) and Microsoft (79%/-8%). Combined, the “Magnificent 7” lost about $3.5 trillion in market capitalization since February 19.

Additionally, the prior strength of the “Magnificent 7” masked the less rosy picture for the “average” stock. According to Bespoke, while the S&P 500 is 9.3% below its ATH, the average stock in the broader Russell 3000 is about 30% below its 52-week high that was on average made on September 22, 2024.

With the “honeymoon” over (the S&P 500 has surrendered all of its post-election gains), some historical perspective might help you survive the storm.

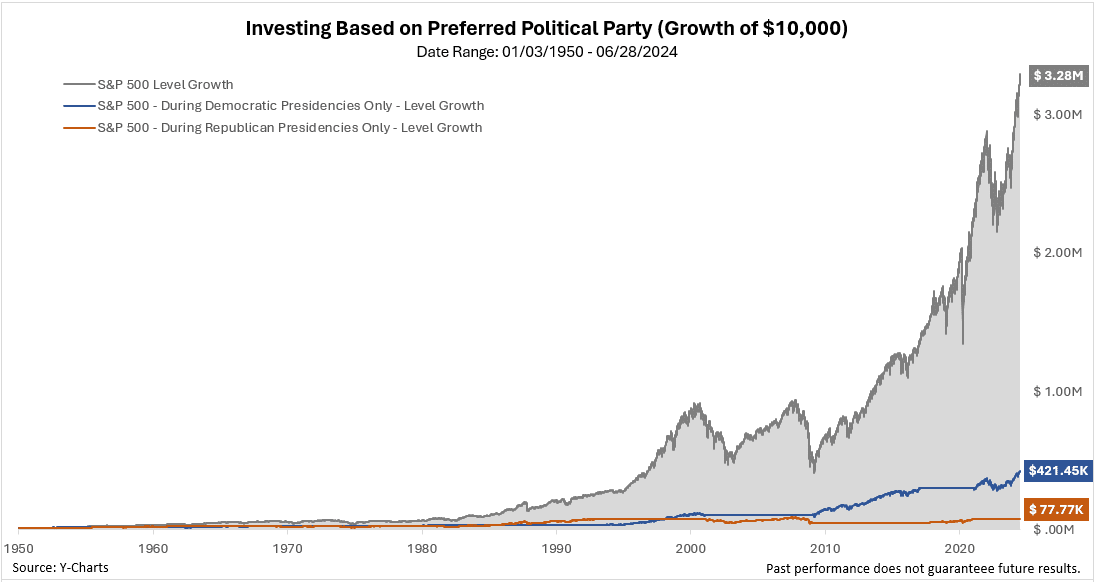

Making an anxiety-based change in your investment strategy because of your political beliefs will be harmful to the long-term health of your portfolio. As pointed out in my column on September 27, 2024, “People fret about elections; the stock market doesn’t,” according to Y-Charts, if you invested $10,000 in the S&P 500 on January 3, 1950 and left it alone, on June 28, 2024 (almost 75 years later) you would have had $3,278,000. However, if you were invested only during Democratic ($421,450) or Republican ($77,720) administrations over the same period, you would have had dramatically less (87% less with Democratic-only and 98% less with Republican-only). Clearly, letting partisan passions control your investment decisions can be very costly.

Stocks aren’t ticker symbols, but represent business ownership sliced into small pieces. The owner of the business is entitled to the future cash flows generated. The intrinsic value of the business is simply the cumulative amount of those future cash flows, discounted back to today (i.e., the “present value” of the future cash flows).

The key is stock prices can be extraordinarily volatile (like recently), but the intrinsic values of the underlying businesses are much less so. “If you’re buying a business, and that’s what stocks are…you’re going to own it for 10- or 20- years,“ Warren Buffett said in late February of 2020 (just as the pandemic was causing the global economy to shutdown). “The real question is: ‘Has the 10-year or 20-year outlook for American business changed in the last 24 hours or 48 hours?’”

Crises happen. We try to invest in businesses that have stood the test of time and navigated economic, political and financial market calamities. Today’s list of risks includes tariffs/trade war, inflation, recession and a “black swan” event. Good companies adapt, so will these matter to the intrinsic value of the business in five or twenty years?

Finally, speaking of “black swans” (extremely low probability, but high impact events), it’s hard to believe February 19 also marked the 5-year anniversary of the start of the most rapid market meltdown in history. With Covid paralyzing economic activity, between February 19 to March 23, 2020 (23 trading days), the S&P 500 dropped a nauseating 33.9%. If you got scared out of stocks, you would have missed the 17.6% surge from March 24-26, the biggest three-day advance in more than 80 years. Clearly, market timing is a fool’s errand.

Downdrafts are completely normal. According to JP Morgan, the average intra-year peak-to-trough drop for the S&P 500 from 1980-2024 was 14.1%, but 34 of 45 years were still positive. You control how much volatility you experience. Stop looking. As Buffett advised, “Games are won by players who focus on the playing field—not by those whose eyes are glued to the scoreboard. If you can enjoy Saturdays and Sundays without looking at stock prices, give it a try on weekdays.”

The opinions expressed in these articles are those of the author as of the date the article was published. These opinions have not been updated or supplemented and may not reflect the author’s views today. The information provided in these articles are not intended to be a forecast of future events, a guarantee of future results and do not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular stock or other investment.