Hoosier native revealed superpower of ‘Simple Man’ lifestyle

Mickey Kim / December 8, 2023

Geoffrey Lincoln Holt was born in 1941 in Indianapolis, IN and passed away this June at 82. By all accounts, Holt lived an unremarkable and anonymous life. A dyslexic, he graduated from the former Marlboro (VT) College in 1963 and joined the Navy. After serving his country, he earned a Master’s degree from American International College and briefly taught high school social studies and drivers’ education.

Holt subsequently worked as a production supervisor at a grain mill, retiring when the mill closed. He spent his last decades as the part-time groundskeeper at the Stearns Mobile Home Park, his cherished home.

Holt died with a secret known only to his closest friend and employer, Edwin “Smoky” Smith: He was a multimillionaire and had decided to leave all his wealth–$3.8 million—”to support projects, programs and organizations that provide health, educational, recreational or cultural benefits” to the residents of his adopted hometown of Hinsdale, NH.

I’m always amazed and awed to read about “salt-of-the-earth” people like Holt who are of modest means, but still manage to amass multimillion dollar estates.

Sylvia Bloom toiled as a legal secretary for the same firm for 67 years until she retired at age 96 and died shortly after. Bloom’s parents were immigrants and she grew up in Brooklyn during the Great Depression. Bloom had no children and lived modestly in a rent-controlled apartment.

Even to those closest to her, Bloom lived a full, but nondescript life. Imagine the surprise her niece and executor of her estate felt when she discovered Bloom had accumulated more than $9 million during her life.

Bloom directed $6.24 million to go to the Henry Street Settlement, the largest individual gift in the social service organization’s 125-year history. An additional $2 million would be split between Hunter College, where she completed her degree at night, and another scholarship fund.

“She was a child of the Depression and she knew what it was like to not have money,” said her niece. Further, “she had a great empathy for other people who were needy and wanted everybody to have a fair shake.”

Ronald Read died at 92. After serving in World War II, Read returned to Brattleboro, VT, where he worked at his brother’s gas station until he retired 25 years later (he “un-retired” shortly thereafter and worked as a janitor at a J.C. Penney).

He, too, lived an uneventful life, except for the fact his estate was valued at $8 million, which he left to the Brattleboro Memorial Hospital and Brooks Memorial Library.

What were Holt, Bloom and Read’s “secret” for accumulating massive wealth? Surely that can’t be possible without winning the lottery, finding the next Apple, trading Bitcoin or engaging in some sort of financial wizardry?

Their “secret” was/is hiding in plain sight. All three saved/invested as much as they could, as soon as they could and let the “miracle of compound interest” do the heavy lifting. They lived frugally and never felt the need to flaunt their wealth.

Holt invested the severance he received when the grain mill closed in the mid-1980s. When she started in 1947, secretaries like Bloom ran their boss’s lives, including tending to their personal investments. When her boss bought a stock, Bloom would buy a much smaller position for herself. Similarly, Read bought stocks throughout his life and owned about 100 stocks when he died, many of which he had held for decades.

Albert Einstein wasn’t an investment guru, but understood the key mathematical concept driving investment returns. He referred to compound interest as “the most powerful force in the universe.” Under the related “Rule of 72,” simply divide 72 by your assumed rate of return to determine the number of years it takes to double your investment. At 6 percent, it takes 12 years. At 12 percent, it takes 6 years.

Assume you buy a $5,000 portfolio at age 20 (and never add a penny) and realize a 12% average annual return. By 26 you would have $10,000, by 32 $20,000, by 38 $40,000, by 44 $80,000, by 50 $160,000, by 56 $320,000, by 62 $640,000, by 68 $1,280,000, by 74 $2,560,000 and by 80 that initial $5,000 investment would be worth a whopping $5,120,000.

According to Crandall-Pierce, the average annual return for the S&P 500 for rolling one-year periods going back to 1950 was 12.5%. However, the actual annual return was seldom close to 12.5% and ranged from -43.3% to 61.2%. That’s right, to average 12.5%, you had to endure -43.3% (without getting scared out of stocks).

Regarding the example of Einstein’s “miracle,” while the first twelve years may seem boring, the last twelve years are positively exhilarating. Everyone wants to go directly to the last twelve years. Unfortunately, that’s not how successful long-term investing works.

In short, Holt/Bloom/Read lived blissfully free of the shackles of caring how others around them lived or what others thought about how they lived. Smith said of his best friend, “he seemed to have what he wanted, but he didn’t want much.”

Financial success isn’t so much about having a lot, but more about not needing a lot.

Selfless to the end, all three “secret multimillionaires” wanted others to benefit from their accumulated wealth. Holt approached the New Hampshire Charitable Foundation with his wishes over 20 years ago. The New York Times quoted Melinda Mosier, VP of Donor Engagement, who said “the unique part is that he kept it quiet. He was very unassuming. He just wanted to give back in a way that was truly about making the community better without any fanfare or recognition on his part.”

What a beautiful thought during this holiday season.

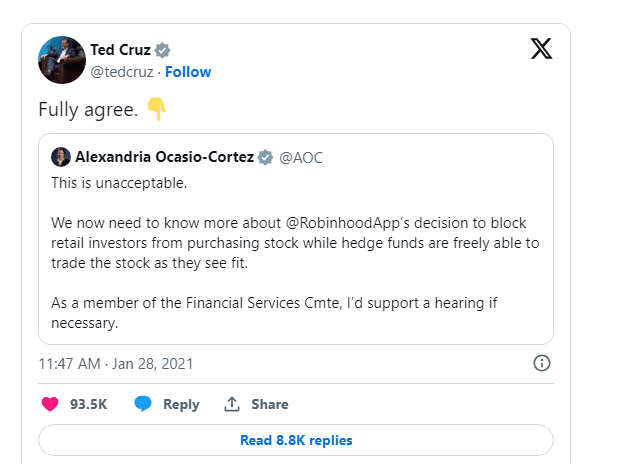

The House Financial Services Committee held three hearings (February 18, March 17 and May 6). The title of its report, “Game Stopped: How the Meme Stock Market Event Exposed Troubling Business Practices, Inadequate Risk Management and the Need For Legislative and Regulatory Reform,” summed up its non-shocking findings. Much to the chagrin of the conspiracy theorists, no plot by Goliath to cheat David was uncovered.

Melvin Capital started 2021 with $12 billion in assets, lost $6.8 billion in January and announced in May 2022 it was closing. Robinhood CEO Vlad Tenev revealed in his testimony half its customers were first-time investors (median age 31), with median and average account size of $240 and $5,000, respectively. With that limited firepower, we think it’s more likely it was other Goliaths like high-frequency trading (HFT) firms and other hedge funds that turned Davids’ “playing with matches” into a raging inferno.

You get on a roller coaster for the thrill of the ride, not to get somewhere. Gill’s initial $53,000 investment briefly hit $48 million, but nobody knows if he had “paper hands” and sold or “diamond hands” and held. As to “Dumb Money,” his testimony said it all. “Social media platforms like YouTube, Twitter and WallStreetBets on Reddit are leveling the playing field. And in a year of quarantines and COVID, engaging with other investors on social media was a safe way to socialize. We had fun.”

The opinions expressed in these articles are those of the author as of the date the article was published. These opinions have not been updated or supplemented and may not reflect the author’s views today. The information provided in these articles are not intended to be a forecast of future events, a guarantee of future results and do not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular stock or other investment.