Dear Clients:

Kirr, Marbach client equity portfolios had excellent performance in 2021, both on an absolute and relative basis. Though we never focus on short-term performance, we’re very pleased with this outcome, particularly given “Value” underperformed “Growth” (yet again) and The Wall Street Journal reported some 85% of actively-managed funds were on pace to underperform the S&P 500 in 2021 (“Stock Pickers Are Struggling to Beat the Market—December 28, 2021).

The price return for the S&P 500 in 2021 (26.9%) ranked as the 12th best since World War II, but investors should expect more modest returns in 2022. To prevent the total collapse of the U.S. economy at the start of the pandemic, the Federal Reserve (“Fed”) slashed short-term interest rates to zero and restarted “quantitative easing” (“QE”), purchasing $80 billion of U.S. Treasury Bonds and $40 billion of mortgage-backed securities on the open market each month, which kept longer-term interest rates low.

With the economy recovering strongly and inflation remaining stubbornly high (increasing from a benign 1.4% at the start of the year to an alarming 7.0% in December, the highest reading since 1982), the Fed has clearly signaled its intention to accelerate the scaling back of these emergency relief measures. The narrative of abundant, ultra-cheap credit was a tide that lifted asset classes of all types. With that narrative now reversing to higher rates and a “hawkish” (on inflation) Fed, that tide is rolling out. As we’ll discuss in more detail, this has created tremendous pressure on assets that had benefitted the most from “free money” (i.e. cheap credit and two rounds of stimulus checks); highly speculative, minimally (if at all) profitable, astronomically-priced technology stocks, “meme” stocks, SPACs, IPOs and cryptocurrencies.

Historically, higher interest rates have been a headwind for stocks, as there is an inverse relationship between rates and price-to-earnings ratios (“P/E”). S&P 500 operating earnings surged about 50% in 2021 from pandemic-depressed 2020, driven by higher revenues and record profit margins. This growth is unlikely to repeat in 2022. Still, if the economy continues to recover (COVID is always a wild card), it’s reasonable to expect corporate earnings to grow by high single digits in 2022. With a high correlation between earnings growth and stock gains, 2022 could be another solid, if unspectacular year. Indeed, while past performance does not guarantee future results, according to Wall Street research firm CFRA, history shows that price returns following years with 20%+ gains since 1945 averaged 10.4% and rose 80% of the time, versus the 9.3% average gain and 74% frequency of advance for all years.

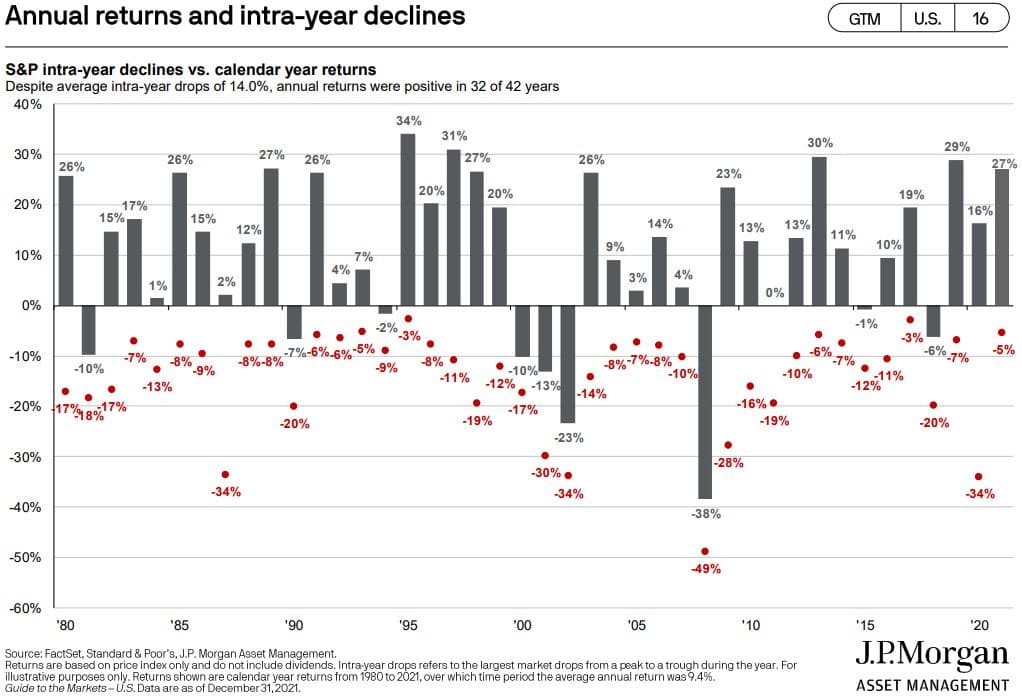

Stocks were remarkably calm in 2021, but with the Fed removing emergency stimulus measures, investors should fasten their seatbelts in 2022. The S&P 500 racked up 70 new all-time highs during 2021, the second highest since the 77 counts posted in 1954 and 1995. Despite the stellar performance and number of new highs, investors experienced extraordinarily low volatility, particularly compared with the gut-wrenching, COVID-induced volatility in 2020. The S&P 500 had only 55 days when the index rose or fell by 1% or more, just slightly ahead of the average of 51 days for all years since WWII. According to J.P. Morgan, going back to 1980 (42 years), the average intra-year drop was 14%, but the maximum drawdown for 2021 occurred from September 2 through October 4 and totaled only 5.2%.

U.S. stocks have stumbled out of the starting gate in 2022, as the yield on the 10-year U.S. Treasury bond has quickly jumped from 1.5% at the end of 2021 to 1.8%, the highest level since last March. Investors are clearly unnerved by the abrupt change in stance from the Fed. It’s not surprising stocks have sold off in early 2022 after a strong 2021 and that the damage has been greater in the higher P/E stocks (think large-cap technology) that are more vulnerable to higher interest rates.

Many investors reflexively react to reversals of Fed policy from “accommodative” to “tighter” as a bad harbinger for stocks, but that’s not necessarily the case. While the Fed raising rates is a headwind, history shows stock returns remain robust in the months leading up to and following the first increase in rates. According to Credit Suisse, over the past four cycles of the Fed raising rates (’94, ’99, ’04 and ’15), the S&P 500 gained 9.5% in the twelve months prior to the initial rate hike and 26.0% over the subsequent three years. Further, the “real damage from higher rates tends to occur later in the cycle when tighter policy flattens/inverts the (yield) curve (a precursor to recession). We are far from that point.”

A new community of investors/speculators emerged during the early stages of the pandemic and seemingly turned the world of traditional investing on its head. Staked by stimulus checks and egged-on by Reddit’s WallStreetBets forum and online brokers like Robinhood touting the “democratization of investing” and “commission-free trades,” “meme” stocks (GameStop, AMC Entertainment), “lockdown” stocks (Peloton), IPOs and SPACs (too many to list) and “disruptive innovation” guru Cathie Wood’s ARK Innovation ETF all soared “to the moon.”

Warren Buffett’s professor, Ben Graham, famously said, “though the stock market functions as a voting machine in the short-run, it acts as a weighing machine in the long-run.” This means fear and greed set prices over short periods of time, but fundamentals (i.e. profitability) eventually determine prices.

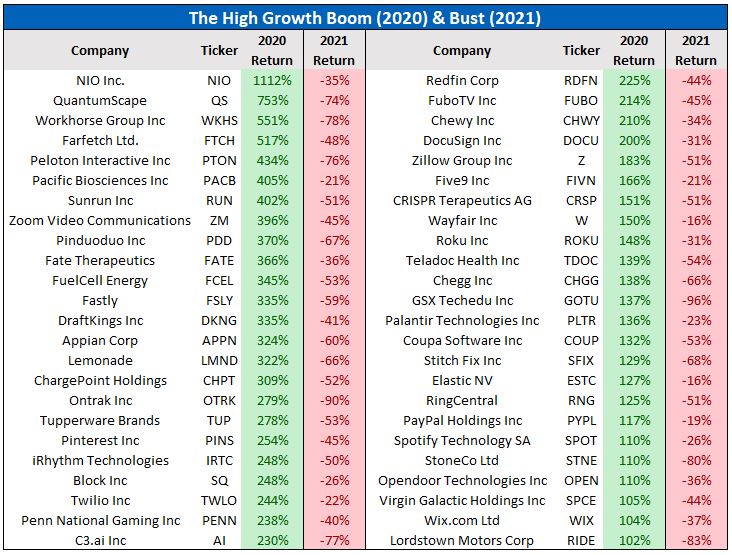

Trees don’t grow to the sky and while the “voting machine” can call the tune for a long while, the “weighing machine” is always lurking in the background and eventually dominates. ARK Innovation had a total return of 152.8% for 2020, but lost 23.4% in 2021 and is already down another whopping 10% in the first 10 days of 2022. Indeed, roughly four in every 10 companies in the Nasdaq Composite Index have seen their stocks cut in half from their 52-week highs, as many of 2020’s highest flyers came crashing back to earth in 2021, as the table below illustrates. Talk about swimming naked!

This is the silly season when “experts”/soothsayers/prognosticators make loud predictions for the markets and economy. For long-term investors, we believe it’s much more effective to focus on understanding the business forces that determine the arc of an individual company’s fortunes and to assess how those fortunes could be impacted by a range of macroeconomic developments, rather than guessing the unknowable. We believe companies with strong profitability and earnings, trading at relatively attractive valuations will do better than high P/E stocks, particularly if rising rates continue to compress P/Es dramatically at the more expensive end of the spectrum.

That said, if you want to think in terms of market forecasts, long-term investors would be wise to focus on 2032, not 2022.

2022

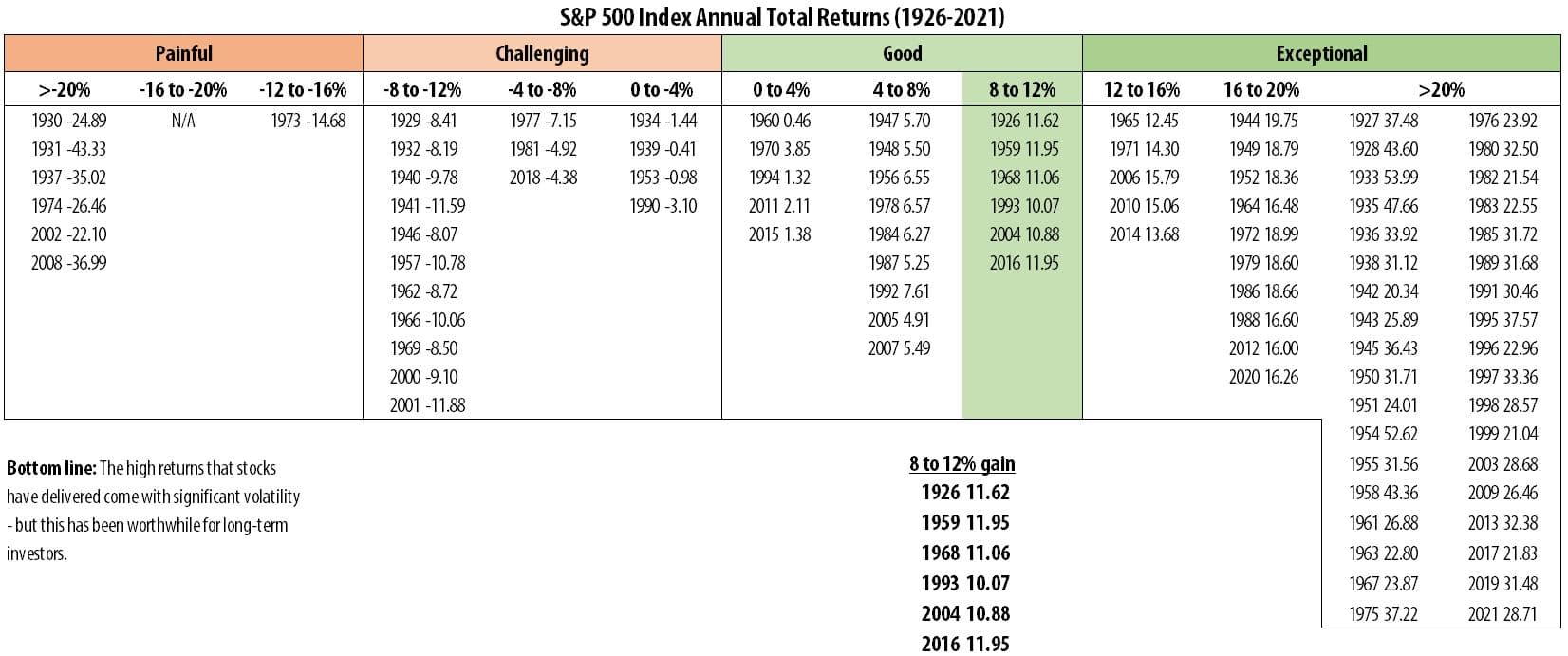

- As shown in the illustration from Hartford Funds below, since 1926 U.S. stocks have averaged an annual calendar year return of 10.5%. Mentally, you might tell yourself a return of plus or minus 20% around the average (i.e. 8-12%) would capture the vast majority of years. While that seems reasonable, you’d be surprised to know the actual return was 8-12% in only six of the 95 years since 1926.

- Similarly, Crandall-Pierce examined rolling 1-year returns for the S&P 500 from January 1950 through December 2021 (71 years). The average annual return over that period was 12.8% and 80% of the rolling 1-year periods were positive. However, the range around that 12.8% average was enormous, from -43.3% to 61.2%.

- Thus, knowing the average historical return for a short-period of time like one-year tells you nothing about what the next year will bring.

2032

- Conversely, Crandall-Pierce also examined rolling 10-year returns for the S&P 500 over the same 71-year period. The average annual return was 10.6%, but returns were positive 97% of the time. In addition, the range around the 10.6% average was much tighter at -3.4% to 19.5%.

- Stretching your time horizon from 1-year to 10-years does wonders for decreasing the volatility and anxiety you’ll experience.

We saw a presentation by Jay Moreland, CFP at a conference a few years back and immediately became clients of his Behavioral Finance Network. Jay’s expertise is helping investors understand the behavioral biases that are hard-wired into our brains and are dangerous to our long-term financial health and how to overcome them. We think he’s brilliant and he’s allowed us to share his forecast for 2022.

Jay’s Dependable Forecast for 2022

Most investors love economic and market forecasts. With the markets so uncertain and volatile, our brain craves some sort of idea of what the future holds. But the markets are unpredictable – evidenced by the fact that no one can consistently predict them with accuracy. Of course, a certain forecast will be right from time to time, just like a broken clock. But market forecasts are not dependable, no matter what your brain tells you.

Unlike market and economic forecasts, my forecast is reliable and robust because it is based on enduring investment truths and investor behavior. These factors are more dependable than market outcomes and more important to an investor’s well-being.

My 2022 Forecast

In full disclosure, the following forecast is nearly identical to my forecast for 2021 and years prior to that.

- The economy/market will do something that surprises us but will be obvious in hindsight.

- Investors who watch the market often will experience more stress than those that don’t.

- You will be tempted to change your investment strategy based on market performance, expert forecasts, and/or your personal beliefs about the future.

- Your investment decisions and reactions to market events will have a significant influence on your personal investment return.

- Investors that focus their time and attention on those things they can control will have a better investment experience than those that focus on what they wish they could control.

Conviction, patience, and discipline are virtues every investor should develop. They aren’t easy, yet they are essential for your success. As your advisor, one of my most important roles is helping you ignore the noise and focus on what really matters to your financial success.

We wish you a prosperous, fulfilling, and happy 2022. Thank you for allowing us to be your trusted partners along the journey.

We’re your “go-to” trusted financial advisor for investments and so much more

Since KM opened its doors for business on May 1, 1975, our singular goal has been to be a friendly, knowledgeable, trustworthy and reassuring source of financial guidance to our clients. Our founding values remain:

- Loyalty. We act as fiduciaries to our clients. Our interests are aligned with yours.

- Humility. We don’t know what’s going to happen next, but we’ve navigated through numerous bull and bear markets, economic booms and busts, market bubbles and crashes and seen investment fads come and go.

- Discipline. We focus on the long-term

- Responsibility. We do what we say we’re going to do.

Our focus since we started more than 46 years ago has been managing portfolios for clients and delivering great client service. A couple years ago we decided to invest in elevating our level of client service and increasing our “value proposition” to our clients by adding Zach Greiner, CFP and Maggie Kamman, CFP, CMA to our business as Associate Directors of Client Service (joining Matt Kirr, Director of Client Service).

We are proud Zach and Maggie have been awarded certification as CERTIFIED FINANCIAL PLANNER, the standard of excellence in financial planning, by the CFP Board. CFP professionals like Zach and Maggie have met rigorous education, training and ethical standards. CFPs are required to master subjects including financial planning, insurance planning, investment planning, tax planning, retirement planning and estate planning.

Financial planning can help you set and reach your goals throughout your life—whether you want to buy a house, save for your kids’ college education, live a fulfilling retirement, leave a legacy for your children or make a difference through philanthropy.

Zach and Maggie are here to assist and guide you, so feel free to reach out if you’re wondering if you have enough money to retire on or have any other financial question, even if it’s unrelated to your investment with KM. If they don’t have the answer, we have a network of experts they can tap. Additionally, Zach, Maggie and Roger Lee, CFP, Senior Research Analyst have developed a presentation on investing basics geared towards younger, less experienced investors. The presentation highlights the vitally important distinction between investing and speculating, which we think this is a critically important message in the current speculative frenzy with meme stocks and cryptocurrency. Our experience is sometimes younger folks are more receptive to messages delivered from someone other than a parent/grandparent!

Regards,

Kirr, Marbach & Company, LLC

Past performance is not a guarantee of future results.

The S&P 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This index cannot be invested in directly.

The S&P 500 Value Index is an unmanaged, capitalization-weighted index that measures the performance of the value segment of the U.S. market for large-capitalization stocks. This index is a subset of the S&P 500 Index and cannot be invested in directly.

The S&P 500 Growth Index is an unmanaged, capitalization-weighted index that measures the performance of the growth segment of the U.S. market for large-capitalization stocks. This index is a subset of the S&P 500 Index and cannot be invested in directly.

Subscribe

Subscribe to stay up to date with the latest news, articles and newsletters from Kirr Marbach.