To view a PDF version of this quarter’s letter, please click here.

Dear Clients:

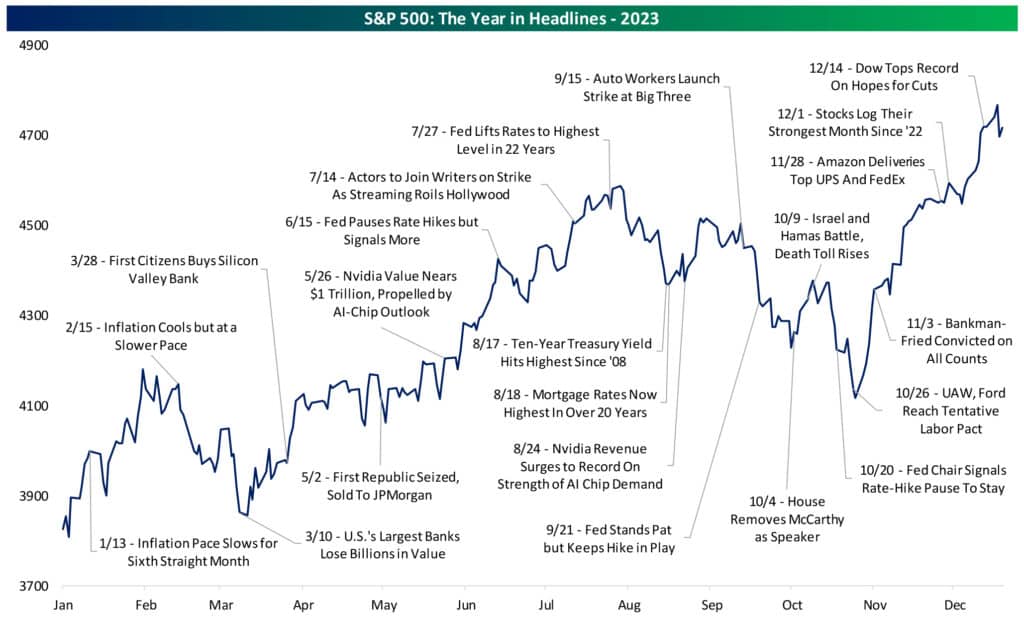

After enduring a brutally frigid “winter” in 2022 that saw the worst year for U.S. stocks since the depths of the Global Financial Crisis (GFC) in 2008 (4th worst for the S&P 500 since 1945) and worst year for bonds ever, investors enjoyed an unexpectedly warm and sweet “summer” in 2023. While the change in seasons was surely welcome, it wasn’t all “strawberries and cream” in 2023. As is always the case, investors faced a number of serious challenges, both expected and “out of the blue.”

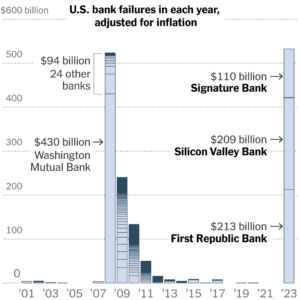

One challenge everyone saw was the Federal Reserve’s ongoing campaign of raising rates and tightening credit to fight inflation. These drove 10-year U.S. Treasury yields to 5% in October and sent 30-year mortgage rates soaring from below 3% as recently as August 2021 to almost 8%, threatening to crush the housing market. One challenge nobody saw coming was the rapid rise in rates (combined with poor decision making) led to the second (First Republic Bank—Assets $213 billion), third (Silicon Valley Bank ($209 billion) and fourth (Signature Bank–$110 billion) largest bank failures in history. These were eclipsed only by the 2008 failure of Washington Mutual ($307 billion), sparking fears of a GFC-style banking crisis.

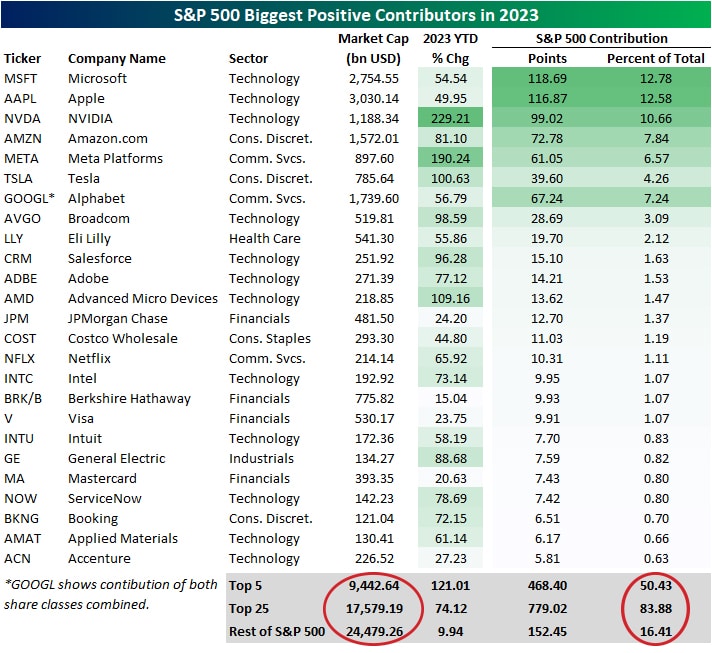

As we’ve discussed in prior quarterly updates, the extraordinary performance of the largest-capitalization stocks distorted what happened with the “average” stock. Recall the S&P 500 Index is capitalization-weighted, which means the performance of the largest-capitalization stocks have a much greater impact on index performance than the smaller-capitalization stocks. As shown in the table below from Bespoke Investment Group, the five largest-capitalization stocks (1% of the stocks in the S&P 500 Index) accounted for just over half the S&P 500 Index total return of 26.3% for 2023. The ten largest (2% of the stocks with combined capitalization-weighting of about 32%) accounted for about 68% of the return. Expanding further to the twenty-five largest (5% of the stocks) picked up almost 84% of the total return, which means the 475 remaining stocks (95% of the stocks) accounted for only about 16% of the gain.

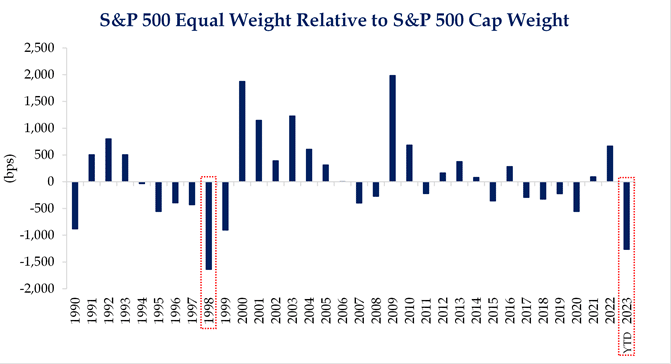

By contrast, the equal-weighted S&P 500 Index (each stock has same 0.2% index weighting) had a total return for 2023 of 13.8%, almost 50% less than the traditional, capitalization-weighted S&P 500 Index. In fact, according to Strategas Research Partners, 2023 was the worst relative year for the “average stock” vs. the S&P 500 Index since 1998 (note while the “average stock” continued to underperform in 1999, the tables turned in a big way in the wake of the “dot-com” bust in 2000). This made for a difficult environment for “active” managers (like us), so against this backdrop we’re very pleased with the performance of stocks held in client portfolios.

2023 Worst Relative Year For the Average Stock Since 1998

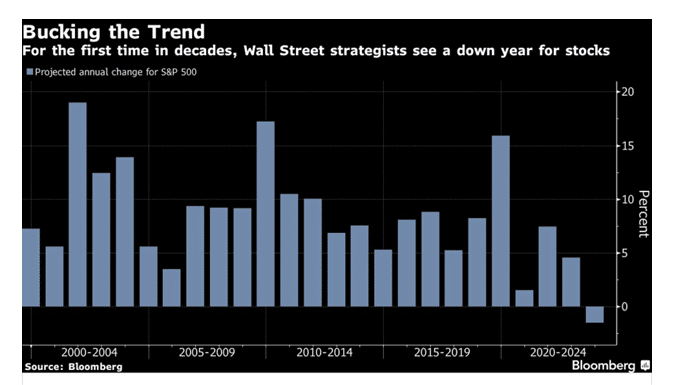

The stock market and economy in 2023 defied the gloomy predictions and prognostications of highly-paid Wall Street strategists and other soothsayers and “experts.” At this time last year, Bloomberg said, “one bad year in the stock market has turned Wall Street strategists into bears after two decades of bullishness.” In fact, the average forecast for the 17 firms Bloomberg tracked called for the S&P 500 to decline in 2023, “the first time the aggregate prediction has been negative since at least 1999.” Further, the best-case forecast called for the S&P 500 to finish 2023 10% higher, while the worst-case predicted a 17% fall, a divergence not seen in over a decade and indicative of a debate over how much and how fast the Fed would continue to raise rates and whether the coming recession would be “shallow” or more akin to the Great Recession.

We’re big believers it’s impossible to accurately forecast markets and/or the economy, so making predictions is a waste of time. Further, as 2023 proved definitively, heeding “expert” predictions can be extremely dangerous and costly; such predictions should be considered “for entertainment purposes only.” Still, ‘tis the season for predictions, so here’s our “non-prediction” from a year ago:

“The pain is real. Pessimism is high. Fear is extreme and understandable. We’re heavily invested alongside you and feel the same emotions. Still, while there are undoubtedly more shoes to drop in 2023 that could cause stocks and bonds to drop further, we believe 1) much of the bad news has already been priced into the market, 2) the regime change from 0% interest rates will finally force investors to focus on company fundamentals and stock valuations, which is how we’ve invested for the past what will be 48-years on May 1, 2023 and 3) it is difficult times like these that present opportunities for long-term investors in a world obsessed with short-term results.”

The S&P 500 Went Exactly Nowhere for 2022-2023

Imagine for a moment you celebrated excessively on New Year’s Eve 2021, fell into a deep slumber and didn’t awaken until New Year’s Eve 2023. The S&P 500 Index was at 4766.18 when you went to sleep on December 31, 2021 and was 4769.83 when you woke up on December 31, 2023, so was essentially unchanged during your two-year hibernation. You might logically surmise nothing happened during those two years.

As you know, nothing could be further from the truth. While you were sleeping, the S&P 500 Index would:

- Reach its high of 56 on January 3, 2022, the first trading day of the year.

- Reach its low of 3577.03 on October 12, 2022, a gut-wrenching, bear market decline of 25.4% from the high.

- Finish 2022 at 50, a loss of 19.4% for the year.

- Reach its 2023 low of 3808.10 on January 5, 2023, the third trading day of the year.

- Reach its 2023 high of 4783.35 on December 28, 2023.

- Finish 2023 at 83, a bull market gain of 24.2% for the year and 33.4% from the October 12, 2022 low.

That’s a lot of miles traveled to go nowhere, but if you got scared out of the market at the bottom, it would have been a very expensive ride!

Fed’s “Pivot” Rescued Investors From Brutal “Winter of 2022”

The proximate cause of the welcome return of summer has been the dramatic slowdown in the post-pandemic inflation. After fears the Federal Reserve (“Fed”) slamming on the monetary brakes to combat soaring inflation would crush economic activity, optimism abounds the Fed has pulled-off a miraculous “soft landing.” Investors have cheered the Fed’s signaling a “pivot” from its program of tightening credit via a series of eleven rapid-fire, jumbo interest rate hikes that took its target for federal funds from 0% at the beginning of 2022 to 5.25%-5.50% in July 2023, a 22-year high.

With inflation stabilizing around 3%, down significantly from its post-pandemic peak of 9.1% in June 2022 (the largest increase since the early 1980s), interest rates have plunged as investors anticipate potential rate reductions in 2024-2025. Reflecting on the darkest days of the GFC, two of the biggest beneficiaries will be the housing market, which many feared would collapse, and the federal government, which may reduce credit rating agency concerns about surging borrowing costs in coming years.

The Fed’s dual mandate is keeping inflation low (2% target) while maintaining “full” employment (4-5% unemployment). Inflation currently stands at 3% and unemployment at 3.7%. With stable prices and employment, the Fed may be in a position to “pivot” and start lowering interest rates.

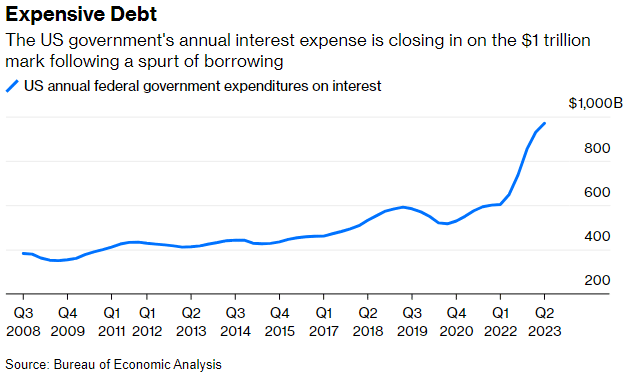

From the government’s perspective, the reduction in interest rates is a much-needed relief. The United States has $34 trillion in debt held by the public and has seen its net interest expense on this debt soar to an extraordinary $659 billion in 2023, nearly doubling in two years. For scale, our November interest expense of $72 billion (15.8% of tax revenue) eclipsed Defense spending for the first time in over 20 years. This is particularly troublesome in a time of rising global conflicts.

Most federal debt was issued when interest rates were extremely low. As these debts mature and have to be refinanced at current rates, the Congressional Budget Office projects massive additional borrowing to fund deficits coupled with higher rates will cause net interest payments to reach $1.4 trillion by 2033, signaling a distressing trend where a growing portion of the federal budget is consumed by interest payments, restricting funding for other critical areas like healthcare, infrastructure and education.

Former director of the Office of Management and Budget (OMB) under President George W. Bush, Indiana governor and Purdue University president Mitch “The Blade” Daniels’ warning from 2011 (US debt $9.5 trillion) rings even louder today.

‘In our nation, in our time, the friends of freedom have an assignment, as great as those of the 1860s, or the 1940s, or the long twilight of the Cold War. As in those days, the American project is menaced by a survival-level threat. We face an enemy, lethal to liberty, and even more implacable than those America has defeated before. We cannot deter it; there is no countervailing danger we can pose. We cannot negotiate with it, any more than with an iceberg or a Great White. I refer, of course, to the debts our nation has amassed for itself over decades of indulgence. It is the new Red Menace, this time consisting of ink. We can debate its origins endlessly and search for villains on ideological grounds, but the reality is pure arithmetic. No enterprise, small or large, public or private, can remain self-governing, let alone successful, so deeply in hock to others as we are about to be.”

The Fed’s decision to cut interest rates to 0% at the start of the pandemic caused many asset bubbles to inflate, including housing. Sub-3% mortgage rates led to greater affordability, leading to an increase in housing demand, even as inflation in construction costs drove up prices.

By 2023, however, the landscape of the housing market shifted with mortgage rates reaching 8% in October. Despite significantly higher rates leading to plunging affordability, housing prices remained stubbornly elevated. In the third quarter of 2023, the median home sale price reached $431,000, a significant 30% increase from $318,400 in the third quarter of 2019, albeit slightly down from its peak of $479,500 in the second quarter of 2022. The resilience of home prices can be attributed to several factors, including a strong job market and ongoing inventory shortages, as homeowners with low-interest mortgages are reluctant to sell.

Mortgage rates have dropped below 7%. Falling rates could breathe new life into demand, reigniting prices. Fears about homeowners becoming “upside-down” (owing more than their property is worth) in a GFC-type housing crash would fade. However, there is a risk lower rates may prompt increased household borrowing and lead lawmakers to defer the difficult work of tackling our growing deficit.

Will the U.S. Economy (Finally) Go Into a Recession in 2024?

Much ink has been spilled in the futile pursuit of predicting when the next recession will begin and how deep it will be. We don’t play that game, but note every economic expansion has been followed by a recession, just as every recession has been followed by an economic expansion. Further, the next recession will be one of the most widely expected/anticipated in recent memory. Short-term yields ended Q4-2023 well above long-term yields for the seventh quarter in a row. When short-term U.S. Treasury yields exceed long-term yields, it’s known as an “inverted yield curve,” a sign investors are pessimistic about the economy. According to Bespoke Investment Group, both the extent and length of the yield curve’s inversion reached uncharted territory in the second half of the year. Still, while an inverted yield curve has preceded every recession, not every inversion has been followed by a recession. Every salmon is a fish, but not every fish is a salmon. Further, the Conference Board’s index of Leading Economic Indicators has declined for 20 straight months, a streak that has been associated with recessions in the past.

For us, not only is the economy impossible to predict, we don’t buy or sell based on anyone’s economic outlook. We invest in businesses, not stock ticker symbols. Although stock prices are driven by fear and greed and are very volatile, the value of the underlying businesses don’t change that much from day-to-day. The businesses we own are profitable now, generate more cash than they consume and generally have “pricing power.” They also generally have “clean” balance sheets with lower-than-average debt levels. We believe stocks of companies with these characteristics will fare well in good times and bad for the economy.

Timeless Advice to Remember and Keep Handy For “Emergencies”

We are clients of Bespoke Investment Group because of their ability to convey sometimes complex investment concepts visually and in a manner that is easy to digest and understand. Bespoke recently published a great piece, “Get Invested. Ten simple slides on the benefits of long-term investing in the stock market”. The best investment advice is truly timeless. We think this piece is in that category and suggest you might want to read it now and keep it in a drawer for the next time (and there will be a next time) other investors are losing their collective minds.

KM’s 2024 “Non-Forecast”

(Courtesy of Jay Moreland, CFP of the Behavioral Finance Network)

Most investors love economic and market forecasts. With the markets so uncertain and volatile, our brain craves some sort of idea of what the future holds. But the markets are unpredictable – evidenced by the fact that no one can consistently predict them with accuracy. Of course, a certain forecast will be right from time to time, just like a broken clock. But market forecasts are not reliable, no matter what your brain tells you.

Unlike market and economic forecasts, our forecast is reliable and robust because it is based on enduring investment truths and investor behavior. These factors are more dependable than market outcomes and more important to an investor’s well-being.

In full disclosure, the following forecast is nearly identical to our forecast from last year and years prior to that.

- The economy/market will do something that surprises us (and the experts). In hindsight we will wonder how we didn’t see it.

- On Monday, March 6, 2023 the stock of Silicon Valley Bank (SVB) closed at $385.19, giving it a market value of more than $15 billion.

- On Friday, March 10, 2023 regulators seized and closed Silicon Valley Bank, citing inadequate liquidity and insolvency, wiping out shareholders.

- What will surprise us in 2024?

- The financial media will emotionalize headlines and short-term market moves to entice you to tune in—so they can achieve better ratings.

- The front-page headline of the March 14, 2023 edition of The Wall Street Journal blared, “SVB Fallout Fuels Bank Stocks’ Rout”

- Essentially the entire 2023 gain for the S&P 500 Index occurred after SVB failed. If scary SVB headlines like that caused you to sell your stocks, you would have missed the entire gain for 2023.

- Investors who watch the news and stock market often will experience more stress than those that don’t.

- This will only get worse as we approach the November election.

- Investors who move to cash, waiting for a “better time” or the “dust to clear,” will suffer significant uncertainty and anxiety about when and how to get back in.

- Your investment decisions and reactions to market events will have a significant impact on your personal investment return.

- You will be tempted to change your investment strategy based on market performance, expert forecasts, and/or your personal beliefs about the future.

- The front-page headline of the March 14, 2023 edition of The Wall Street Journal blared, “SVB Fallout Fuels Bank Stocks’ Rout”

Conviction, patience, and discipline are virtues every investor should develop. They aren’t easy, yet they are essential for your success. As your adviser, one of our most important roles is helping you ignore the noise and focus on what really matters to your financial success.

We wish you a prosperous, fulfilling, and happy 2024. Thank you for allowing us to be your trusted partner along the journey.

Regards,

Kirr, Marbach & Company, LLC

Past performance is not a guarantee of future results.

The S&P 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This index cannot be invested in directly.