To view a PDF version of this quarter’s letter, please click here.

Dear Clients:

U.S. stocks posted exceptionally strong performance in the first quarter of 2024, building on the significant gains from the fourth quarter of 2023 and capping a 12-month period that saw the S&P 500 Index generate a total return of 29.8%. Corporate earnings remain healthy, the economy has apparently dodged a long-feared deep recession (the Conference Board’s Leading Economic Index (LEI), a composite index comprised of 10 economic indicators designed to predict the future health of the economy turned positive in February, ending a streak of 23 straight months of declines dating back to March 2022), employment is solid and the Federal Reserve remains poised to reduce interest rates, albeit the start will likely be later and number of cuts smaller than originally hoped. The S&P 500 posted a total return of 10.6% in the first quarter, which Wall Street research firm CFRA said was the 11th best first quarter showing since 1945. Further, the S&P 500 set 22 new all-time highs, the sixth-greatest Q1 count since WWII.

Even better, the market’s advance in the first quarter of 2024 was more broad-based than it was in 2023, when the “Magnificent Seven” stocks accounted for a massively disproportionate share of S&P 500 performance, meaning client equity portfolios experienced good absolute and relative performance. Further, the gains have come with very low volatility. According to Bespoke Investment Group, the S&P 500 has gone over 100 trading days without a 2% decline, only the eighth time since 1952 the S&P 500 has gone that long or longer without a pullback of that magnitude.

Putting it all together, the stock market over the past several months has been a high-return, low-volatility unicorn. While this type of blissful environment is certainly enjoyable, it will come to an end next week, next month or even later. It would be wise to keep overconfidence and cockiness in check, as “the market” has a way of punishing those who fly too close to the sun. The last time investors savored a similar high-return, low-volatility treat was 2021. Financial markets are impossible to forecast and we’re not predicting ensuing indigestion like 2022, but realize we’re heading into a political storm, our nation’s spending and level of debt remain out of control (and will only get worse in an election year), inflation and interest rates are still too high and geopolitical turmoil abounds around the world.

With the S&P 500 at a record high, is it too late to buy?

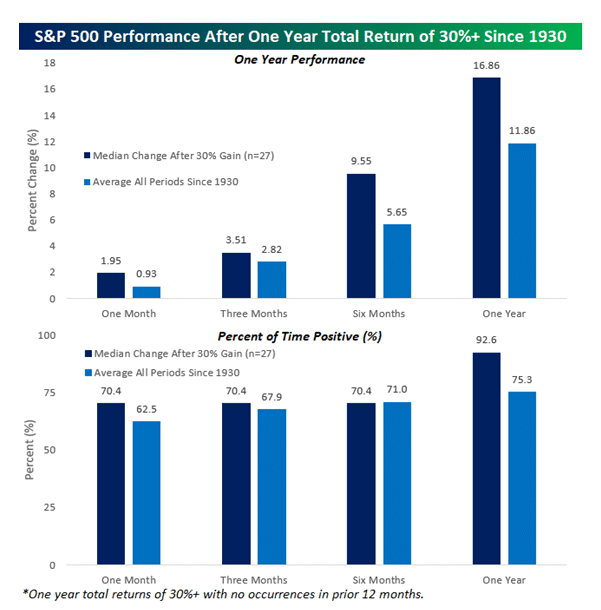

As stated above, a correction can occur at any time, but according to Bespoke, the S&P 500’s median performance one-, three-, six- and twelve-months after initially rallying 30% in a year was better than average for all periods, in some cases significantly so. Just because stocks have had a big rally doesn’t mean the advance can’t keep going.

As shown in Bespoke’s illustration below, one month later the S&P 500’s median gain of 1.95% was more than twice the historical average of 0.93% and the median six-month gain of 9.55% was almost four full percentage points greater than the historical average for all periods since 1930. Regarding consistency, the S&P 500 was higher one-year later 25 out of 27 times (93%), which was considerably better than the 75% frequency of positive returns for all 12-month periods.

Keep calm and don’t mix politics with your portfolio

Now that a November rematch between President Joe Biden and former President Donald Trump is a fait accompli, it’s time for investors to prepare themselves mentally for the impending political storm. We never make predictions, particularly in writing, but it’s a sure bet the vitriol and partisan political assault we’re all going to be bombarded with over the next seven months will make 2020 seem like a songfest around the campfire.

Both Biden and Trump (and their supporters) predict doom if the other is elected. Information is filtered through the lens of confirmation bias, our tendency to give too much weight to findings that support our existing beliefs. Unfortunately, it’s increasingly rare for folks (including us) to listen openly to opposing views, let alone seek out alternate perspectives and attempt to understand.

Unfortunately, as our country has become even more politically polarized, people tend to seek comfort in print, TV and social media “echo chambers.” As Simon & Garfunkel sang in The Boxer, “a man hears what he wants to hear and disregards the rest.”

As the partisan storm increases in intensity over the coming months, you may be tempted to make changes to your portfolio because of how you believe a short-term event like an election will impact the financial markets. Don’t. Making an anxiety-based change because of your political beliefs will be harmful to the long-term health of your portfolio.

The president is only one of many factors that influence the market. Others, including corporate profitability, interest rates and inflation may have more impact than who resides in the White House.

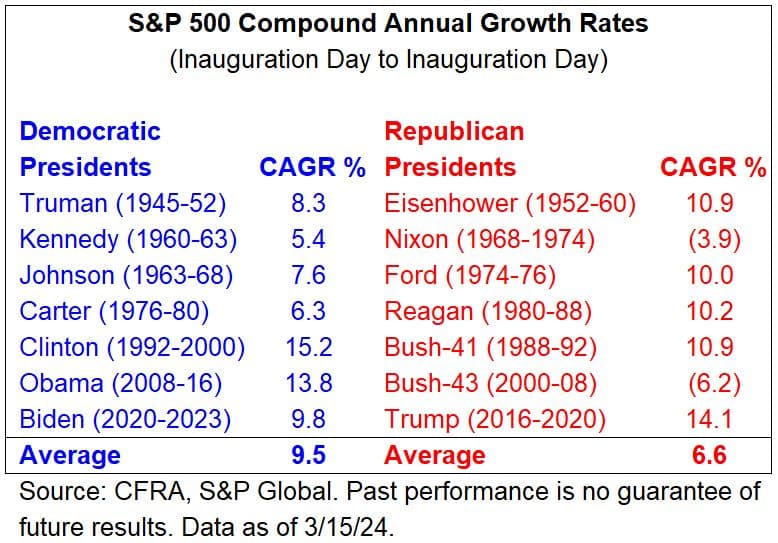

Sam Stovall, Chief Investment Strategist for CFRA, dissected price changes for the S&P 500 going back to 1945 based on election results.

Republican administrations are generally viewed as “pro-business” and conventional wisdom is stocks do better with a Republican in the White House. There has, indeed, been a huge difference in returns during Democratic vs. Republican administrations. However, as is often the case, conventional wisdom is wrong. Past performance is no guarantee of future results, but Stovall calculated from Harry Truman’s inauguration on April 12, 1945 through March 15, 2024, the average annual return for the S&P 500 was 44% higher with Democrats in the White House (9.5% vs. 6.6% during Republican administrations).

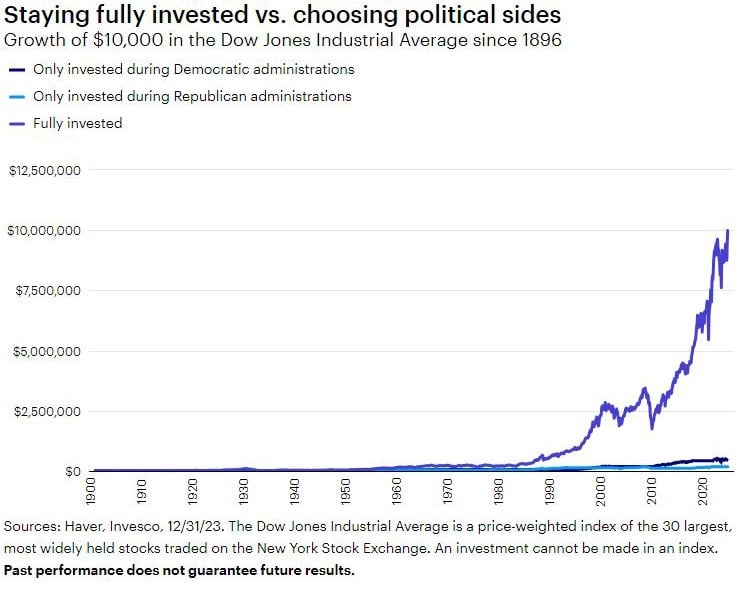

Further, according to Invesco and Haver Analytics, hypothetically speaking, the best-performing portfolio from 1900 to 2023 was the “bi-partisan” one that stayed fully-invested in the Dow Jones Industrial Average (a price-weighted index (cannot be invested in directly) of the 30 largest, most widely held stocks traded on the New York Stock Exchange) during both Democratic and Republican administrations. Again, past performance is no guarantee of future results, but starting with $10.000, this portfolio grew to almost $9.9 million.

Conversely, a “partisan” portfolio, invested only during Democratic or Republican administrations underperformed by millions of dollars. The same $10,000 invested only during Democratic administrations grew to about $528.000. Invested only during Republican administrations, the initial $10.000 grew to a bit less than $181,000.

As you can see, there can be a huge cost to letting a partisan political storm crash your portfolio. Develop an investment plan based on your long-term goals and stick to it. Your financial future will depend far more on how much you save and invest, not who wins the election.

Do you remember how you felt on March 9, 2009?

The 15th Anniversary of the Global Financial Crisis (GFC) bear market low came and went with little fanfare or even notice. The S&P 500 went from 1565.25 on October 9, 2007 to 676.53 on March 9, 2009, a brutal 17-month decline of almost 57%. The GFC was the greatest economic crisis since the Great Depression. Economic activity was crushed, millions of jobs were lost and retirement savings decimated. Fear and despair ruled the day, as you can see in the online post from The Wall Street Journal after the market close on March 9, 2009.

The GFC was the most severe test of investor fortitude since the Great Depression. In times of extreme stress our basic survival instinct kicks in, so it’s not surprising many well-intentioned investors sold on the way down. As you can tell from the article, there was absolutely nothing to suggest the stock market had reached a bottom on March 9, 2009. That’s how it always is. The Dow Jones Industrial Average reached 39,807.37 at the end of the first quarter of 2024 (up 708% since March 9, 2009), the S&P 500 5254.35 (up 877%) and Nasdaq Composite 16,379.46 (up 1391%).

The rub is only those with the fortitude to hold reaped the rewards. As our friend Jay Mooreland, CFP of the Behavioral Finance Network says, “selling during scary and uncertain times usually is referred to as ‘getting to safety.’ While getting to safety provides an immediate psychological benefit, it often results in a very real financial cost. Next time you feel the need to ‘get to safety’ perhaps it can be re-framed as ‘reducing my future return.’ Because no one sells and gets back in at the bottom. The only way to participate in all the gains of the market is to ride out all the temporary losses that come along the way.”

“When markets are scary, uncertain and the outlook is dire, the natural reaction is to sell,” Moreland continued. As you can see in the very long-term graph from Crandall-Pierce, our fortitude has been tested many times since March 9, 2009. We can assure you it will be tested many more times in the months and years ahead. Realize as investors this volatility is a normal part of our journey and what we’ve all signed-up for. Holding through the inevitable and occasional difficult periods so we can let the “Miracle of Compound Interest” work its magic is hard, but that’s why you have us in your corner!

Regulatory Update

Kirr, Marbach & Company, LLC (KM) is registered with the U.S. Securities and Exchange Commission (“SEC”), which requires advisers to file Forms ADV-Part 1, Part 2A (“Brochure”), Part 2B (“Brochure Supplements”) and Part 3 (“Form CRS-Client Relationship Summary) electronically on the Investment Adviser Registration Depository (www.iard.com). KM filed its annual updating amendments to its Forms ADV-Parts 1, 2A and 2B on March 27, 2024.

Form ADV-Part 2A is a narrative disclosure of an adviser’s business, written in “plain English.” The SEC mandated the headings, specific topics to be covered and the order of presentation.

If you would like a printed copy of KM’s ADV-Part 2A “Brochure” (or ADV-Part 1, Part 2B or Part 3), please contact Matt Kirr, Director of Client Service ([email protected]), Zach Greiner, CFP, Director of Client Service ([email protected]) or Maggie Kamman, CMA, CFP, Director of Operations ([email protected]) at 812-376-9444 or 800-808-9444 and they’ll be happy to mail to you. Alternatively, you can find KM’s ADV-Part 2A and Part 3 posted on our website www.kirrmar.com under About Us/Regulatory Filings.

Regards,

Kirr, Marbach & Company, LLC

Past performance is not a guarantee of future results.

The S&P 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This index cannot be invested in directly.

The Dow Jones Industrial Average (“DJIA”) is an unmanaged index comprised of common stocks of thirty major industrial companies. This Index cannot be invested in directly.

The NASDAQ Composite Index is an unmanaged, capitalization-weighted index that measures the performance of more than 3,000 securities that are all listed on the NASDAQ stock market. This index cannot be invested in directly.