STAY CALM, STAY IN AND STAY THE COURSE

March 9, 2020

These past few weeks have been historic in terms of market volatility. Panic seems to be reaching a crescendo today, with stock market “circuit breakers” kicking in for the first time since the Great Financial Crisis of a decade ago. We understand many of you are feeling scared and anxious. It certainly doesn’t feel good to us, either. Still, our primary task as your trusted advisor is to maintain a steady hand on the helm when the seas turn rough, as they are today. In that spirit, we’d like to share a piece from Lord Abbett we think provides great historical perspective and sound, timeless advice to “Stay Calm, Stay In and Stay the Course.” We also think you may find this piece from Legg Mason about why today’s headlines aren’t “new” news useful and informative.

STAY CALM

The truth is that market ups and downs are normal.

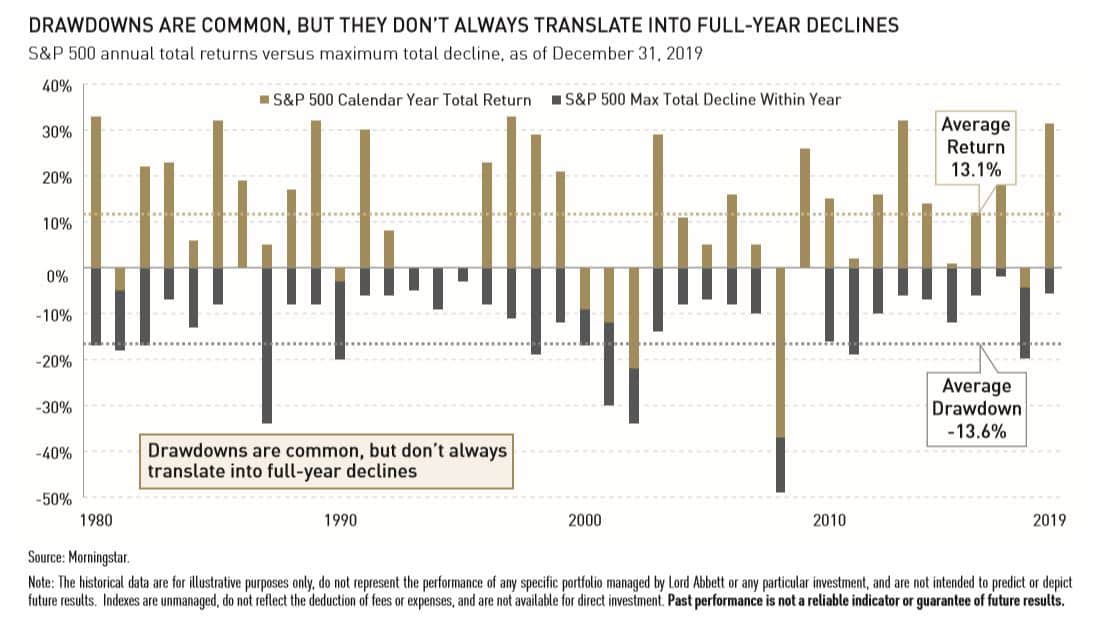

In fact, in any given calendar year, the average drawdown (peak to trough decline) of the S&P 500® Index historically has been nearly 14%.

Though such favorable outcomes can never be guaranteed, it is clear that being calm and patient during periods of volatility historically has rewarded investors.

STAY IN

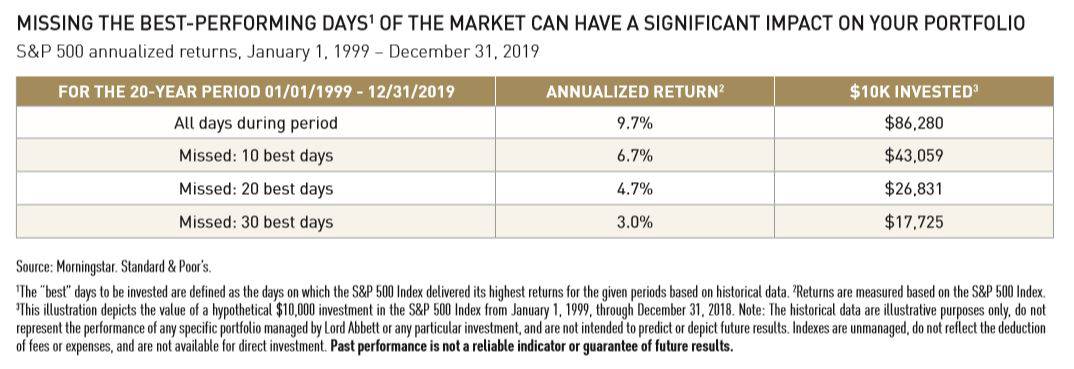

An investor who exited the market and subsequently missed just 10 of the best-performing days in the past 20 years would have lost out on more than half of the gains. Given the difficulty of market-timing, a far better course would have been to stay in, with the knowledge that volatility is normal and that missed upside can dramatically cut into long-term returns.

STAY THE COURSE

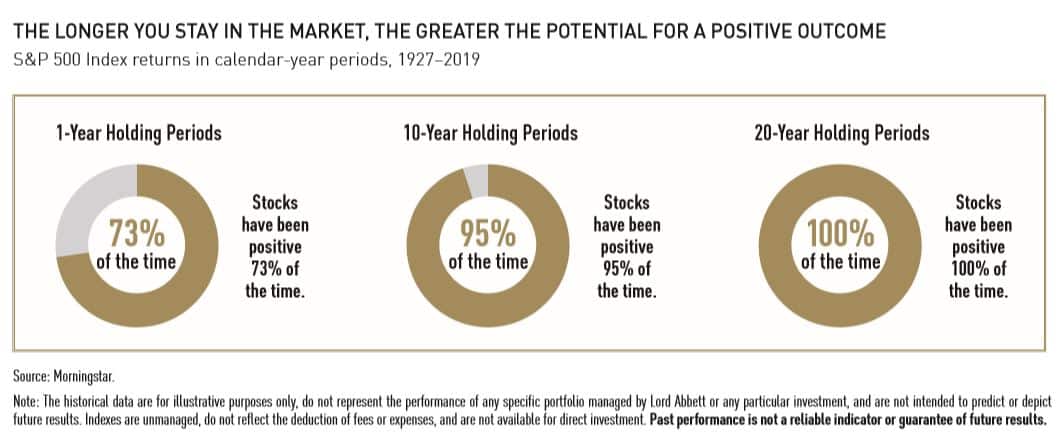

For long-term equity investors, the most powerful factor is time: historically speaking, an investor’s time horizon is directly correlated with the likelihood that a portfolio will experience positive returns. For these long-term investors, staying the course is the most critical consideration when trying to build wealth and meet their investment objectives.

Subscribe

Subscribe to stay up to date with the latest news, articles and newsletters from Kirr Marbach.