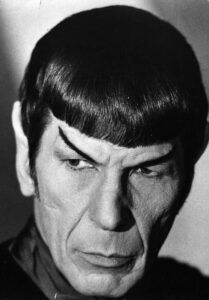

To understand stocks’ wild price swings, think of it as a “Spock” Market

Mickey Kim / July 3, 2020

That low was reached on March 23rd, the day the Federal Reserve announced a major expansion of its effort to address the economic fallout and signaling it was prepared to utilize every monetary tool in its arsenal to the maximum extent. Four days later, the $2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act was enacted, demonstrating lawmakers’ resolve to bring an unlimited amount of fiscal firepower to the fight.

Investors were optimistic the Fed and Congress had learned the lessons from the Great Financial Crisis (GFC) a decade ago and were aggressively implementing many of the same policies that were developed “on the fly” back then. This “whatever it takes” mentality led panic selling to quickly morph into fear of missing out (FOMO), as the S&P 500 surged 17.6% from March 24-26, the biggest three-day advance in more than 80 years. Stocks continued higher, with the S&P 500 posting its best 50-trading day rally in more than 75 years.

On June 8, the National Bureau of Economic Research, the official arbiter of the start and end of recessions, declared the severity and breadth of the pandemic-induced plunge in economic activity had forced the U.S. economy into a recession in February, marking the end of the 128-month expansion that started in June 2009, the longest in records going back to 1854.

How can you explain the stock market’s wild mood swings from the depths of despair to soaring optimism (both in the face of a dismal economic environment)? Financial columnist Barry Ritholtz suggests if you think of the “Spock market” instead of the stock market, the “raging disconnect between the economy and equity prices becomes easier to grasp.”

For non-Trekkies, Mr. Spock was science officer and second-in-command aboard the starship USS Enterprise in the “Star Trek” media franchise. Spock’s mother (Amanda Grayson) was human and his father (Sarek) was Vulcan, a race known for “hyper-rationalism.” Spock’s human side was emotional and irrational and his Vulcan, logical side often struggled to keep it under control.

Much of the time investors are rational and the stock market is understandable and makes intuitive sense, says Ritholtz. When the economy is expanding and profits are growing, prices rise. If the economy tanks, prices plunge. However, there are other times investors are clearly irrational. When fear or greed take hold of the steering wheel, anything can happen. Ritholtz says this is apparent at major turning points in the market, such as the top of the dot-com bubble in March 2000 and the bottom of the GFC in March 2009.

Most recently, this was apparent in the wild, totally illogical trading in the worthless stocks of bankrupt companies (like Hertz) as bored folks with stimulus money to burn flocked to the only open “casino” in town. This was not surprising in this brave new world of “commission-free” trades and stock trading apps like Robinhood (which opened mind-blowing 3 million new accounts in the first quarter) whose user interface makes “investing” seem as easy and addictive as playing a video game.

What could go wrong?

Ritholtz said “Spock’s mixed human-Vulcan heritage was a great plot device that allowed ‘Star Trek’ to subtly comment on the human condition, exploring the tension between logic and emotion, between our intellectual capabilities and baser drives. Investors who recognize and take account of the Spock market will better understand what’s going on, and –one can hope—use it to guide their actions for better results.”

Was the market’s surge from the March 23 low was an illogical disconnect from a reeling economy or a logical look past the valley to a better post-COVID world? It seems likely the market’s path will be determined by the ebb and flow in the war on COVID. Soothsayers claim to see the future, but nobody knows, no matter how confident they sound.

Until then, Spock would say there will never be a vaccine for human nature.

The opinions expressed in these articles are those of the author as of the date the article was published. These opinions have not been updated or supplemented and may not reflect the author’s views today. The information provided in these articles does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular stock or other investment.

Subscribe

Subscribe to stay up to date with the latest news, articles and newsletters from Kirr Marbach.