Dear Clients:

The good news is, as of September 30, 2020, client equity portfolios had their strongest two-quarter performance since the third and fourth quarters of 2010. The bad news is “Value” continued to lag “Growth” significantly in the third quarter of 2020, an all too familiar refrain. However, we’ve completed implementation of the modification of our investment strategy we discussed in our most recent client letter. As we’ll review below, we’ve increased our exposure to higher quality, larger-capitalization stocks. Though we’ve been willing to pay more for quality/size, we’re still 100% committed to finding undervalued stocks (i.e. not buying overvalued stocks just because they’re going up).

There are no guarantees in investing, but we’re confident the changes we’ve made will be positive for performance going forward.

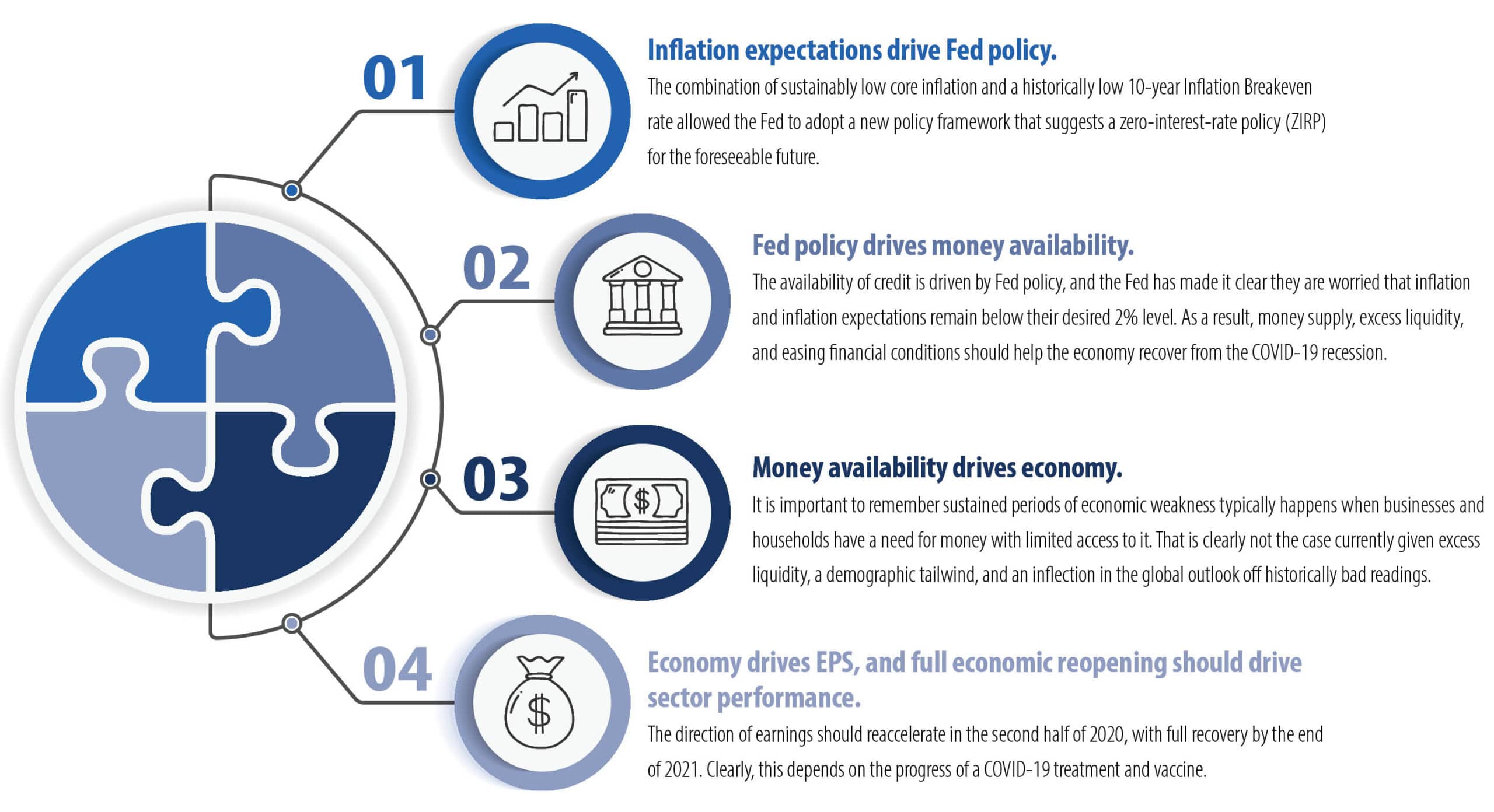

We always preach it’s best to focus on the “signal” and ignore the “noise” (there will be plenty leading up to the election). While there are certainly a number of negative for stocks (market dominated by handful of mega-cap technology stocks, stratospheric technology sector valuations, overheated IPO market and individual investors with speculative, FOMO fever, to name a few), we think the positives outweigh. As shown in the infographic below, we think the Fed’s aggressive support of the economy and financial markets by keeping interest rates extremely low and providing copious amounts of liquidity will provide a bridge until the COVID storm passes and the economy and corporate earnings recover. Stock prices follow earnings, so this should be good for the market.

COVID-era “K-Train” heads in different directions for haves, have-nots

Would it be a “V” (sharp decline, followed quickly by an equally sharp rebound), “W,” “U,” “L,” or even a “Nike Swoosh” (not yet the 27th letter)?

The letter “K” is a vertical line with two 45-degree lines slanting from the middle, one upward and one downward.

Unfortunately, “K” best describes the paths of the economy and stock market since the nadir (hopefully) of the COVID pandemic in March. The gap between the “haves” and “have-nots” has further widened over the intervening six months, resulting in the “haves” having more (sometimes much more) and the “have nots” having less (oftentimes much less).

The “happy,” upward-slanting line symbolizes those parts of the economy that actually benefitted from the pandemic.

Technology companies like Apple, Microsoft and Zoom gained from the massive, almost instantaneous switch from offices to “working from home (WFH).” Netflix entertained us as we were confined to our homes. Retailers like Target, Walmart and Costco sold huge amounts of staples like toilet paper and household cleaners. Home improvement chains like Home Depot and Lowe’s gained as folks decided to fix-up their homes. Online retailers like Amazon and Overstock continued to gobble market share from brick and mortar competitors because, who wants to go to a mall/store during a pandemic?

Not surprisingly, the Direxion Work From Home ETF (Ticker: WFH) was recently launched to make it easy for the Robinhood crowd to jump on the bandwagon with a single click.

The “sad,” downward-slanting line symbolizes pretty much everything else.

The list of companies hurt by the pandemic is much longer and contains a boatload of bankruptcies, with more sure to come. For mall retailers that were already teetering like J.C. Penney, Pier One, Brooks Brothers and others, the pandemic was just the coup de grace. Any business dependent on physical customers, like commercial airlines, hotels and restaurants, is facing an existential crisis like never before.

The situation is even more dire for small, privately-held businesses, which employ the majority of Americans. Yelp reported that as of the end of August, 163,735 businesses indicated they were closed, a 23% increase from mid-July. Nearly 100,000 of these closures are permanent. Further, the National Restaurant Association said at least 100,000 restaurants are closed (nearly one in six), three million restaurant employees are without a job and the industry is on pace to lose $240 billion in sales by the end of the year. More alarmingly, with cold weather approaching, 40% of owners surveyed said they are likely to close within six months without additional government support.

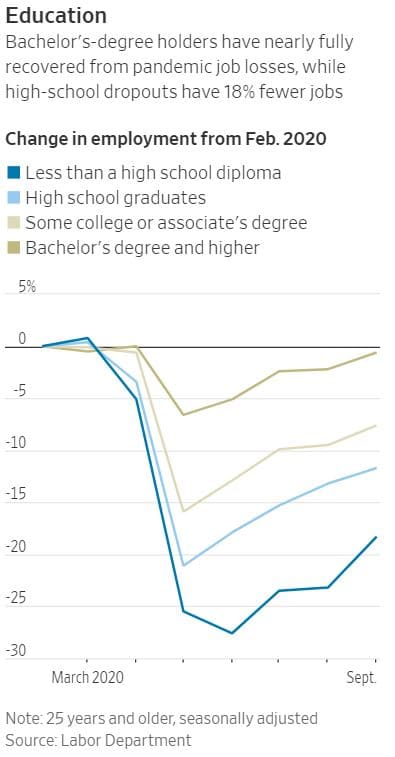

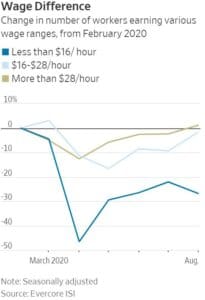

On the employment front, the pandemic and lockdowns caused the loss of 22.2 million jobs in March and April. Recent gains have cut the loss in half, but is still above the 8.7 million jobs lost in the Great Recession of 2007-2009. In addition, the recovery in jobs has been extremely stratified. As shown in the two illustrations below, those with higher levels of education and income (who typically have white collar jobs that can be done remotely) have fared much better than those with lower levels of education and income (who typically have blue collar jobs that require in-person work). Unfortunately, those are the same folks who typically had little or no financial cushion going into the pandemic.

Way back on February 19, the S&P 500 reached a record high. As the government effectively shut down the economy in an attempt to contain the pandemic, panic ensued, with the S&P 500 plunging 34% over the next five weeks, marking the market’s fasted trip ever into bear territory and ending an 11-year bull run. Incredibly, by September 2 the S&P 500 made a new record high, as investors seemingly put COVID in the rearview mirror.

How can you reconcile the disconnect between the joy on Wall Street and the continuing pain on Main Street?

First, there is an old investing adage, “don’t fight the Fed,” which means if the Federal Reserve wants to support stocks with lower interest rates (like now), stock prices are unlikely to act contrary. Indeed, the Fed recently stated it would refrain from raising rates until “maximum employment” has been reached and inflation is on track to moderately exceed the Fed’s 2% inflation target.

This is a momentous change, as the Fed will no longer serve as “chaperone” and “take away the punch bowl just as the party is getting going” by raising rates to head off inflation.

Second, with bond yields approaching zero, investors are facing the reality of TINA, or There is No Alternative (to stocks). In other words, the Fed is forcing investors into riskier assets.

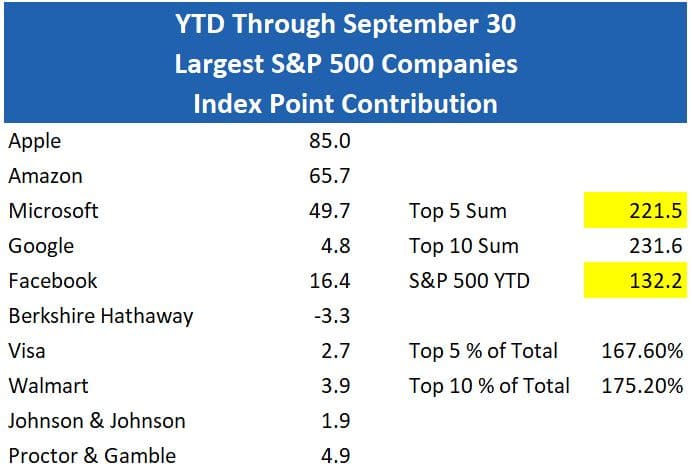

Third, this is one of those times the S&P 500 is a terrible proxy for the performance of the “average” stock. The S&P 500 is a capitalization-weighted index, which means the performance of the largest-capitalization (i.e. stock price times number of shares outstanding) stocks impact index returns much more than the smaller-capitalization stocks.

For instance, Apple recently became the first U.S. company to attain a market capitalization of $2 trillion, more than the total market capitalization of the entire Russell 2000 small-capitalization index. Indeed, the “Fab-Five” largest-capitalization stocks in the S&P 500 (i.e. 1% of the stocks)—Apple (up 58% year-to-date (YTD) through September), Amazon (70%), Microsoft (33%), Google parent Alphabet (9%) and Facebook (28%)—recently had a combined index weight of 23%, the highest concentration in 30 years.

The tables from Bespoke Investment Group below compare the five-largest capitalization stocks now vs. in 2010. As you can see, the Top 5 have more than double the combined index weighting now as they did in 2010 and each stock in the Top 5 today is in the same sector (i.e. Technology), whereas there is usually more diverse sector representation.

“What did the market do today?” is a common question. The correct answer is, “it depends.” For the past several years, it’s meant “what did the mega-capitalization technology stocks do today?” Indeed, while the S&P 500 had a total return of 8.9% YTD through September, the version of the S&P 500 that gives an equal 0.2% weight to each of the 500 stocks had a total return of minus 4.8%. As shown in the table below from Strategas, the “Fab 5” mega-capitalization stocks represented more than 100% of the YTD total point gain for the S&P 500, which means the S&P 500 would have been solidly negative without them. There clearly was a huge cost to not owning those stocks.

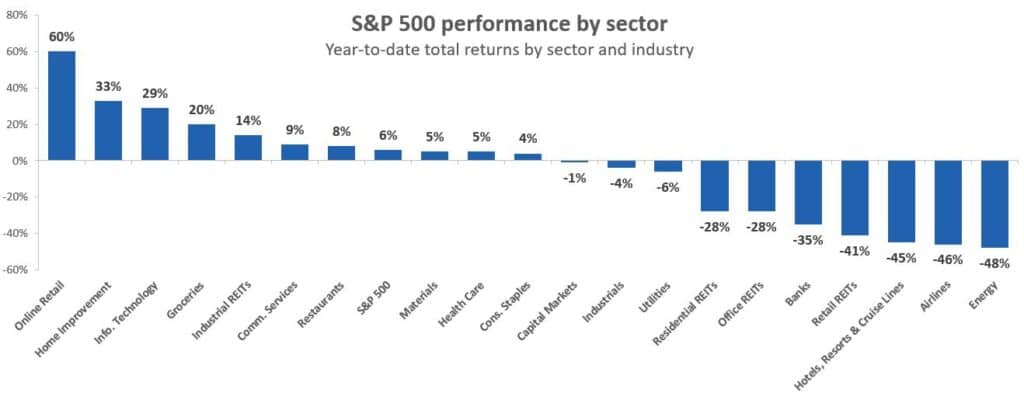

The massive gains in the mega-capitalization technology stocks masked weakness in low-index weight sectors that have been decimated, like Energy (2.1% weight—down 48%), which simply don’t register.

“Price is What You Pay; Value is What You Get”—Warren Buffett

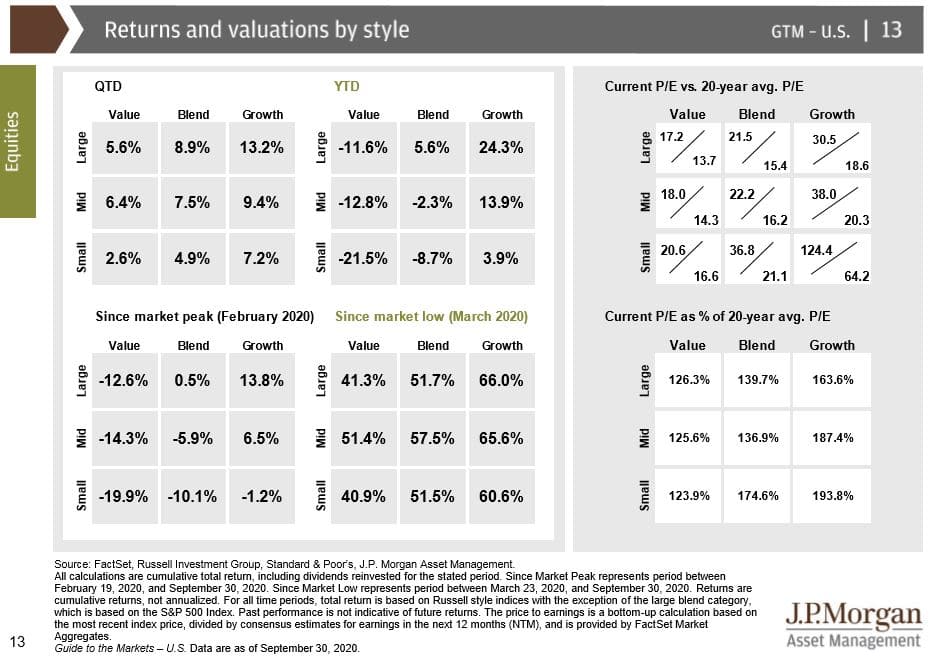

As you can see in the illustration below from J.P. Morgan Asset Management, “Value” lagged significantly behind “Growth” in the third quarter and year-to-date, whether small-, mid- or large-capitalization. In addition, this also held true for the periods since the market peak in February and trough in March.

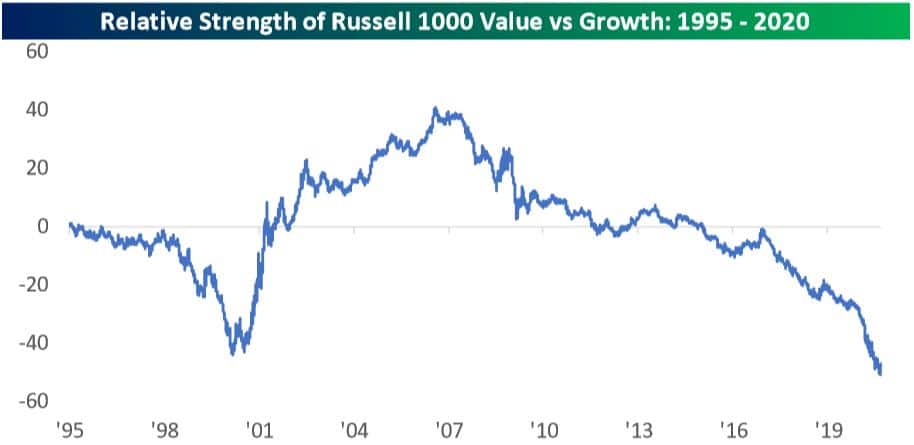

As we’re all painfully aware and as shown in the next illustration, “Value” has lived on the sad, downward slanting leg of the “K” and underperformed “Growth” fairly consistently over the past ten plus years. In fact, according to investment behemoth BlackRock, “if we look at Fama/French (University of Chicago professors) data, which starts in 1925, this value drawdown we’ve had since January 2007 is the worst one, and now it is the longest duration.” Sure, there were brief periods when “Value” shined, but those were few and far between. As you can see in the illustration below from Bespoke Investment Group, the relative outperformance of “Growth” over “Value” is now greater than at the peak of the Tech/Dot-Com bubble twenty years ago.

This year, the pandemic has made both the amount and timing of the growth in corporate earnings highly uncertain. This has caused investors to flock to the stocks of companies that have been beneficiaries of the pandemic (more on that later), no matter how expensive. Call this approach “growth at any price.”

In addition, the value of a stock is determined by the stream of earnings the company will generate between now and forever, “discounted” back to today. The “discount rate,” in turn, is determined by the level of interest rates. In general, the lower the discount rate, the higher today’s value (“present value”) of the future earnings stream. Further, changes in the discount rate impact the value of earnings far in the future much more than current earnings. With interest rates approaching zero, the discount rate is also very low, which puts a higher value on the future earnings stream. Many “Growth” stocks have little to no current earnings, but potentially big earnings far down the road, so have benefitted greatly from this phenomenon.

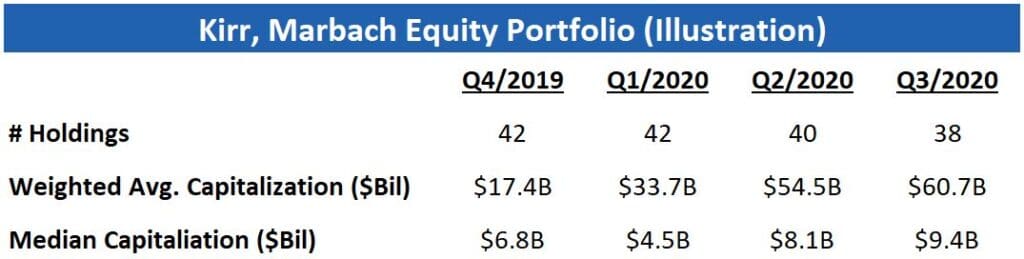

As we’ve alluded to in the past, we view market downdrafts as opportunities to upgrade the quality of client equity portfolios (i.e. buying larger-capitalization, higher-quality stocks of better businesses we previously viewed as too expensive). As shown in the table below, we’ve made a fairly dramatic move up the market capitalization scale in 2020. Hopefully, these bigger companies will be better able to withstand both the normal rough and tumble of everyday business, as well as exogenous, unexpected shocks like pandemics.

As we stated in our most recent client letter, we remain steadfast to our “Value” discipline, but think it makes good sense to broaden our definition of “Value,” a term that has become to mean strictly “low-multiple,” whether that refers to price-to-earnings, enterprise value –to-EBITDA, cash flow or other metrics. Whereas these valuation metrics can be useful in screening the universe of stocks for possible investment candidates, you have to assess a company’s products, competitive position, growth prospects, quality of management and many other factors before you can judge whether a cheap stock is a “cigar butt” or undervalued opportunity.

Warren Buffett made a similar pivot. In this 1989 letter to Berkshire Hathaway shareholders, he said: “If you buy a stock at a sufficiently low price, there will usually be some hiccup in the fortunes of the business that gives you a chance to unload at a decent profit, even though the long-term performance of the business may be terrible. I call this the ‘cigar butt’ approach to investing. A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the ‘bargain purchase’ will make that puff all profit.”

Berkshire’s Vice-Chairman, Charlie Munger, convinced Buffett investing in discarded cigar butts was not going to cut it as Berkshire reached gargantuan size, so they should look for investment value in great businesses whose operations and/or stock price were temporarily under pressure. Indeed, Berkshire owns 5.7% of Apple Inc., which is by far its largest common stock investment (more than twice as big as #2).

We’ll always be “Value” investors, but are focused on finding undervalued stocks of better businesses and leave the “cigar butts” lying in the street. We firmly believe the fortunes of “Value” will turn for the better at some point. Our portfolio should benefit, if and when this happens. Until then, we think it makes good sense to not have our fortunes so closely tied to this eventuality. Call this approach “growth at a reasonable price.”

Don’t let partisan political storm crash your portfolio

It’s a sure bet vitriol and emotions will be at a full boil between now and the election. Both President Trump and Vice-President Biden (and their supporters) predict doom if the other is elected. Information is filtered through the lens of confirmation bias, our tendency to give too much weight to findings that support our existing beliefs. Unfortunately, it’s increasingly rare for folks (including us) to listen openly to opposing views, let alone seek out alternate perspectives and attempt to understand.

As Simon & Garfunkel sang in The Boxer, “a man hears what he wants to hear and disregards the rest.”

As the partisan storm increases in intensity over the coming days, you may be tempted to make changes to your portfolio because of how you believe a short-term event like an election will impact the financial markets. Don’t. Making an anxiety-based change because of your political beliefs will be harmful to the long-term health of your portfolio.

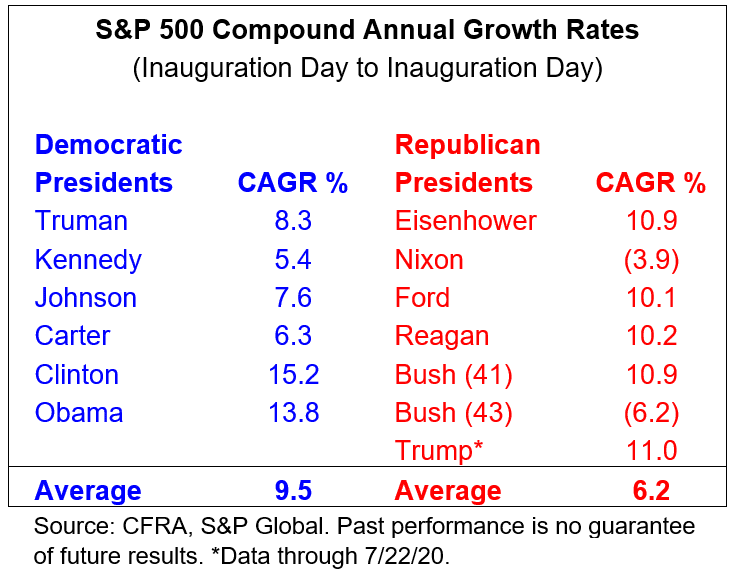

Sam Stovall, Chief Investment Strategist for Wall Street research firm CFRA, dissected price changes for the S&P 500 going back to 1945 based on election results.

Republican administrations are generally viewed as “pro-business” and conventional wisdom is stocks do better with a Republican in the White House. There has, indeed, been a significant difference in returns during Democratic vs. Republican administrations. However, as is often the case, conventional wisdom is wrong. Stovall calculated from Harry Truman’s inauguration on April 12, 1945 through July 22, 2020, the average annual return for the S&P 500 was 9.5% with Democrats in the White House vs. 6.2% during Republican administrations.

The president is only one of many factors that influence the market. In addition, as shown above, the directional impact of who wins the election may not be what you think. Other factors, including corporate profitability, interest rates and inflation may have more impact than who resides in the White House.

Try not to fret about things you can’t control. Instead, develop an investment plan based on your long-term goals and stick to it. Your financial future will depend far more on how much you save and invest, not who wins the election.

Turn off the TV and read that book you’ve been meaning to get to.

There’s always a reason to panic, but don’t

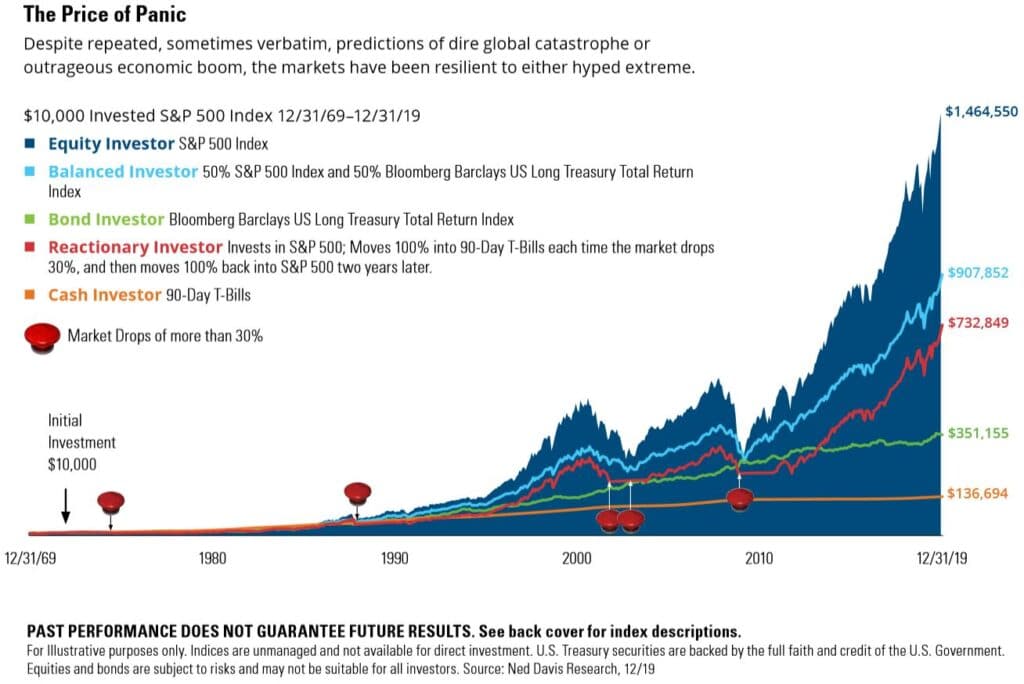

As we experienced in March, stocks can hit a downdraft and decline 30% or more in the blink of an eye, for any or no reason at all. It’s just the nature of the beast. When the market is plunging and the headlines and talking heads are screaming, “don’t just sit there, do something,” it may seem perfectly rational to “play it safe” by selling stocks and waiting to re-enter until things “settle down.”

Nobody likes to lose money and behavioral science tells us the pain of losing is twice as great as the pleasure of gaining the same amount. Although “safer” investments like money markets/government bonds may reduce your anxiety, choosing safety can cause significant damage to your long-term returns. Even if you are lucky enough to time the sale, by the time things “settle down,” the “get back in” train will have left the station long ago.

The illustration below shows how two hypothetical investors who invested $10,000 in the S&P 500 on December 31, 1969 did over the fifty years ending December 31, 2019. The first investor (“buy and hold”) rode out the five 30%+ market drops and ended with $1,464,550. The second investor (“reactionary”) sought “safety” whenever stocks plunged 30% by moving 100% into U.S. Treasury Bills and reinvesting in stocks two years later and ended with $732,849, about half of what he would have had if he had done nothing and left it alone. In other words, this “reactionary” investor purchased short-term comfort for $731,701, a steep price to pay!

Summary

We’re pleased we’ve been able to make up ground over the past two quarters, but realize we have a long way to go. We are confident our strategy to increase the size and quality of the companies in the portfolio, while still maintaining our “Value” discipline, will prove to be correct. Finally, we should all realize with the upcoming election and ongoing battle with the pandemic, the last quarter of 2020 will likely be a harrowing ride.

As always, we are big believers in “eating our own cooking” and have significant personal investments alongside you. We’re investing your precious assets the same way we’re investing our own. In other words, we’re putting our money where our mouths are!

We thank you for the trust and confidence you’ve placed in us as we try to navigate these difficult, unprecedented times.

KM Privacy Policy Notice

Under Securities and Exchange Commission Regulation S-P, KM is required to deliver its Privacy Policy Notice to each client prior to the establishment of an account and updates annually. We are delivering our 2019 annual update to each client account with this letter. In addition, given the increasing importance of protecting clients’ personal information, we have implemented a policy whereby KM personnel will not release any information about a client’s account without specific authorization from the client. If you would like KM to release information about your account to your CPA or other service provider, please contact Director of Client Service Matt Kirr ([email protected]), Associate Director of Client Service Zach Greiner ([email protected]) or Associate Director of Client Service Maggie Kamman ([email protected]) by e-mail or at 812-376-9444 or 800-808-9444.

Regards,

Kirr, Marbach & Company, LLC

Past performance is not a guarantee of future results.

The S&P 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This index cannot be invested in directly.

Bloomberg Barclays US Aggregate Bond Index is composed of securities from the Bloomberg Barclays Government/Credit Bond Index, MortgageBacked Securities Index, Asset-Backed Securities Index, and Commercial Mortgage-Backed Securities Index. This index cannot be invested in directly.

Bloomberg Barclays US Long Treasury Total Return Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 10 years or more to maturity. This index cannot be invested in directly.

Subscribe

Subscribe to stay up to date with the latest news, articles and newsletters from Kirr Marbach.