Dear Clients:

What a difference 12-months makes! The U.S. stock market bottomed on March 23, 2020 after the S&P 500 Index had plunged a harrowing 34% in just 23 trading days, it’s most rapid meltdown in history. Many Investors were understandably shell-shocked and nobody could have predicted stocks would be at record highs just a year later. While our stomachs felt queasy, our minds told us the downdraft was an opportunity to upgrade the quality of client equity portfolios by buying higher-quality, larger-capitalization stocks of better businesses we previously viewed as too expensive.

While we always preach about the importance of not focusing on short-term performance, we are still pleased performance in the first quarter of 2021 was exceptionally strong, both on an absolute basis and relative to the S&P 500 Index. Further, our results in the first quarter of 2021 maintained the positive trend from the fourth quarter of 2020, which led to our performance for the 12-months ending March 31, 2021 being our highest one-year return in more than a decade.

Even better, the good news has continued into the early part of the second quarter of 2021.

This drove home the lesson stocks are inherently volatile, so it’s vitally important for long-term investors to stay calm, stay in and stay the course. Indeed, if you had been scared out of the market on March 23, you would have missed both the biggest daily percentage gain since 1933 (9.4% on March 24) and largest three-day advance in more than 80 years (17.6% from March 24-26). If you’re out of the market, you simply cannot make up those missed opportunities!

The Post-COVID Comeback for Value Continues

While we remain committed to our “Value” investing style, we think it makes good sense to not get too hung up on labels and broaden our definition of “Value,” a term that had come to mean strictly “low-multiple,” whether that refers to price-to-earnings, enterprise value –to-EBITDA, cash flow or other metrics. Whereas these valuation metrics can be useful in screening the universe of stocks for possible investment candidates, you have to assess a company’s products, competitive position, growth prospects, quality of management and many other factors before you can judge whether a cheap stock is a discarded “cigar butt” lying in the street or undervalued opportunity.

In other words, value is where you find it. Investors can often find value among “Growth” stocks while “Value” stocks are often cheap for good reasons. As Warren Buffett advised, “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Though we’ve been willing to pay more for size and quality, we’re still 100% committed to finding undervalued stocks (not buying overvalued stocks just because they’re going up). We firmly believed the fortunes of “Value” would turn for the better at some point (as they have) and our portfolio would benefit, if and when that happened. Until then, we thought it wise to also buy some wonderful companies at attractive prices.

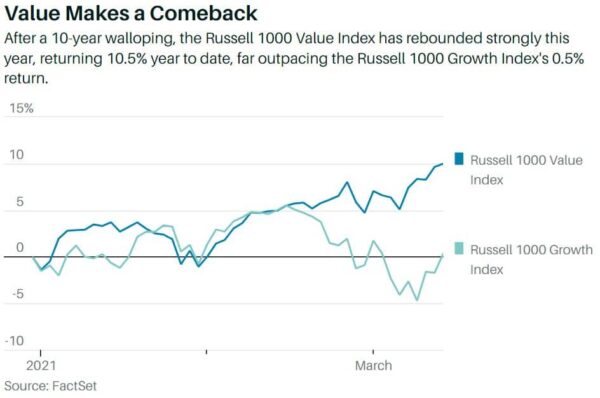

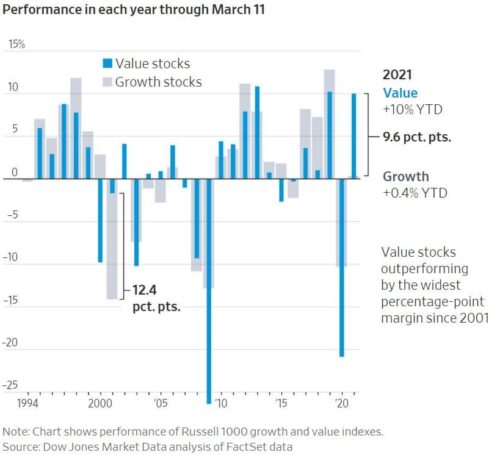

As always, past performance is no guarantee of future results, but this is precisely how our strategy has played out. Although “Value” underperformed “Growth” by the biggest margin on record for the full year 2020, “Value” staged an impressive comeback in the final quarter of 2020 and first quarter of 2021, as the “growth scarcity” premium that powered the mega-capitalization technology darlings abated as progress on the COVID vaccine front brought visibility to the reopening/recovery of the economy.

This led to the LONG-overdue and strongest rotation from “Growth” into “Value” in a decade.

In addition, the rise in interest rates caused by the recovery in activity caused by the post-COVID reopening of economy and the multiple trillions of spending on economic stimulus and infrastructure restrained the performance of the high-growth FAAMG stocks (Facebook (up 7.8% in Q1-2021), Apple (down 7.9%), Amazon (down 5.0%), Microsoft (up 6.0%) and Google (up 17.7%)) that drive performance of the S&P 500 Index.

Regardless of what Roaring Kitty preaches to his army of followers on Reddit’s WallStreetBets forum, owning a stock is owning a piece of a business, the value of which is determined by the stream of earnings the company will generate between now and forever, “discounted” back to today. The “discount rate,” in turn, is determined by the level of interest rates. In general, the lower the discount rate, the higher today’s value (“present value”) of the future earnings stream.

Further, changes in the discount rate impact the present value of earnings far in the future much more than current earnings. When interest rates approached zero, the discount rate was also very low, which put a higher value on the future earnings stream. Many “Growth” stocks have little to no current earnings, but potentially big earnings far down the road, so they benefitted greatly from this phenomenon. By the same token, when interest rates and the discount rate increased, they were hurt.

Bond investors facing Q1-2021 statement sticker shock

Conventional investment wisdom is stocks are “risky” and bonds are “safe.” Owning stocks is exciting—you can make or lose a bundle. Bonds are boring—you don’t make much, but you can’t lose money, either.

Governments and corporations borrow by issuing bonds, which are a contract between the borrower and lender spelling out the timing and amount of interest to be paid (i.e. the “coupon”) and when the principal amount borrowed is to be repaid (i.e. the “maturity”). Because the amount and timing of the cash flows are contractually set, bonds are referred to as “fixed income” investments.

Although the cash flows are fixed by contract, the price of a bond will fluctuate based on interest rate risk and credit risk.

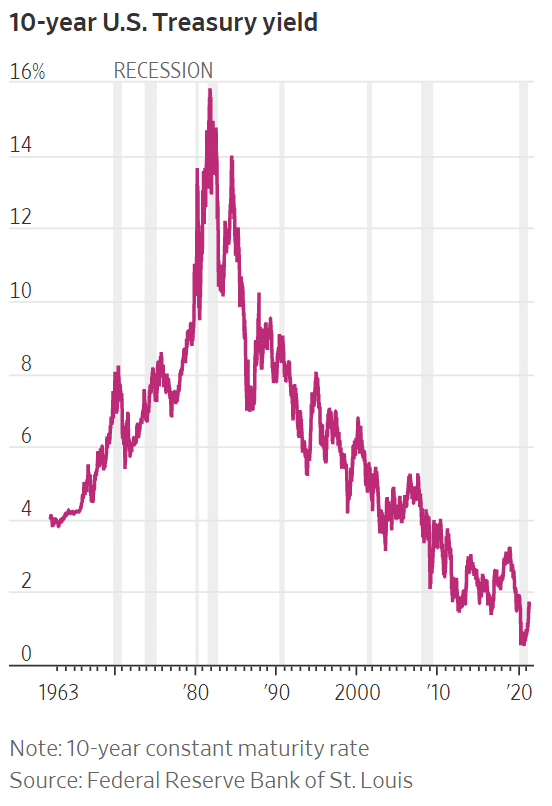

For the past 40 years, the conventional wisdom has been generally correct. The graph above shows the yield on the benchmark 10-year U.S. Treasury Bond (UST) declined from a high of 15.8% at the end of September 1981 to 0.9% at the end of 2020. Mortgage rates track the 10-year UST, so that’s why U.S. homeowners have benefitted from both the lowest rates in history and the related surge in property values.

When interest rates are falling, a borrower can offer new bonds with a lower coupon than the higher coupons on bonds issued in the past, making the fixed income stream on existing bonds more valuable and causing bond prices to go up. Conversely, when rates are rising, existing bonds go down in price. Thus, bond investors have enjoyed a glorious, mostly uninterrupted bull market for the past four decades. Sweet! Additionally, since the end of the Global Financial Crisis (GFC) in 2009, investors have pulled about $780 billion from U.S. stock funds (ironically during one of the greatest bull markets for stocks of all time) and put about $2.8 trillion into U.S. bond funds.

Unlike stocks, there is no upside beyond receiving the contractual payments. Credit analysis determines whether you’re being paid enough to compensate you for the risk the issuer defaults. The higher the credit risk, the higher the interest rate you should demand. For U.S. corporate bonds, this compensation is expressed as the interest rate “spread” vs. the comparable maturity UST (considered a “risk-free” credit because the government can always print more money).

Bonds rated “investment grade” by the three primary U.S. credit rating agencies (Standard & Poor’s Global Ratings, Moody’s and Fitch Ratings) traded at spreads as wide as 6% during the GFC, 4% during last year’s COVID panic and currently a tiny 1%. Similarly, “non-investment grade” or “junk” bonds traded as wide as 20% during the GFC, 9% last spring and now about 3.4%.

Bond investors will learn when they open their March 31, 2021 account statements that the conventional wisdom is sometimes wrong (even after 40 years), as the yield on the 10-year UST jumped to 1.70% on March 31, leading to a loss of 4.6% for the overall UST market for the quarter, according to ICE Indices. Further, USTs maturing in more than 15 years lost a whopping 13%. This was the worst quarterly performance for the UST market in more than 40 years.

It shouldn’t be unexpected or surprising that sub-1% yields were unsustainable in light of a U.S. economy setting-up for a post-COVID recovery and trillions in stimulus and infrastructure spending that will have to be funded by the government issuing bonds.

Until recently, bond investors have enjoyed the best of both worlds as yields on USTs marched steadily lower and credit spreads contracted. With yields and spreads at historic lows and mathematically highly unlikely to go lower, investors are facing a lot of risk with very little reward.

We attempt to mitigate interest rate and credit risk by utilizing defined-maturity bond ETFs (specifically Invesco BulletShares). Contrary to a conventional bond fund that does not have a maturity date and is highly sensitive to interest rate changes, these ETFs distribute principal at maturity similar to an individual bond. To help manage interest rate risk, we construct shorter-term bond “ladders” for client bond portfolios. “Laddering” is the practice of buying bonds that mature in consecutive calendar years, and then reinvesting the proceeds from maturing principal into new bonds that extend the ladder out another year. By keeping maturities short, we minimize exposure to interest rate fluctuations and ensure our clients always have sufficient liquidity to meet their cash needs. Similarly, the ETFs hold hundreds of individual bonds, which reduces credit risk.

Summary

We are aware good three-month, six-month or even one-year periods don’t necessarily mark the beginning of a reversal of the painful trend of the massive outperformance of “Growth.” We can’t say for sure our (and your) frustrating multi-year walk through the performance desert is finally over. There have been what proved to be false starts before and there’s no guarantee Lucy won’t pull the football away again. In fact, we’d be surprised if there aren’t setbacks along the way. We’ll continue to follow Dr. Pasteur’s example and be tenacious in our pursuit of value.

Regulatory Update

Kirr, Marbach & Company, LLC (KM) is registered with the U.S. Securities and Exchange Commission (“SEC”), which requires advisers to file Forms ADV-Part 1, Part 2A (“Brochure”), Part 2B (“Brochure Supplements”) and Part 3 (“Form CRS-Client Relationship Summary) electronically on the Investment Adviser Registration Depository (www.iard.com). KM filed our annual updating amendments to its Forms ADV-Parts 1, 2A and 2B on March 24, 2021.

Form ADV-Part 2A is a narrative disclosure of an adviser’s business, written in “plain English.” The SEC mandated the headings, specific topics to be covered and the order of presentation.

If you would like a printed copy of KM’s ADV-Part 2A “Brochure” (or ADV-Part 1, Part 2B or Part 3), please contact Matt Kirr, Director of Client Service ([email protected]), Zach Greiner, Associate Director of Client Service ([email protected]) or Maggie Kamman, Associate Director of Client Service ([email protected]) at 812-376-9444 or 800-808-9444 and they’ll be happy to mail to you. Alternatively, you can find KM’s ADV-Part 2A and Part 3 posted on our website here.

Regards,

Kirr, Marbach & Company, LLC

Past performance is not a guarantee of future results.

The S&P 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This index cannot be invested in directly.

Subscribe

Subscribe to stay up to date with the latest news, articles and newsletters from Kirr Marbach.