Dear Clients:

As the media has reported ad nauseam, the first half of 2022 was the worst start to a year for the U.S. stock market in over 50 years. Additionally, it was the worst start for the bond market ever. We are currently in a bear market (usually defined as declines greater than 20%), with the S&P 500 Index (SPX) posting a total year-to-date return of minus 19.96% as of June 30, 2022 (with the SPX down 21.08% from its January 3 peak). This is not something to be feared, just understood. We’d like to share five important points to maintain good perspective:

- The history of the market is still being written. “Worst ever” and “best ever” will continue to occur and dominate the headlines. The print, TV and online media will have a heyday with it. We simply accept it as a fact of life and choose to stay out of the mess.

- While bear markets are very uncomfortable and can instill fear, they are an essential elementof healthy capital markets. They squeeze out the excess, encourage companies to become more efficient and pave the way for the next bull market.

- The greatest asset an investor has is personal choice. We cannot control (nor predict) markets or macroeconomic things like inflation or recession, but we control how we respond. Some will seek “safety” and choose to sell in the face of losses. We think it is far better to exercise patience and “strategic ignorance” – choosing to ignore and cultivate an attitude of indifference to financial news and account values until these things get worked out.

- Investor angst is at an all-time high. $5/gallon gas is constantly in our face and the combination of sky-high inflation, the Federal Reserve (Fed) aggressively tightening credit and a potentially looming recession has crushed investor confidence, which is at a 10-year low. Don’t get shook. If history is any guide, and there is no guarantee it is, it’s not uncommon for stocks to have sharp rebounds following horrible half-years like the one we just experienced.

-

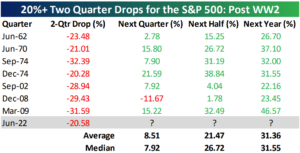

- According to Bespoke Investment Group, the first half of 2022 was just the eighth time since WWII when the SPX dropped 20%+ in a two-quarter span. As shown in the table below, the SPX was up the following quarter in six out of the prior seven occurrences (average gain 8.5%), and the following half- (21.5%) and full-year (31.3%) all seven times.

-

- It may seem like the sky is falling, but relative to the rest of the world, we’re still in very good shape. As shown in the graph below, the US Dollar is at a 20-year high, which means the U.S. is viewed as an attractive place to invest/spend.

5. As we stated in “Our Thoughts on Recent Market Volatility” (June 14, 2022), we invest in businesses, not ticker symbols. The businesses we own are profitable now, generate more cash than they consume and generally have “pricing power.” They also generally have “clean” balance sheets with lower-than-average debt levels. We believe stocks of companies with these characteristics will fare much better in an environment of higher inflation/interest rates than those whose eventual profitability is many years down the road (if at all) and depended on an endless stream of cheap credit.

Inflation & Recession

- We are in a period of high inflation. While it may not keep going higher, these elevated levels will likely persist for a while. With the Federal Reserve (Fed) attempting to fight inflationary pressures by reversing its pandemic-induced emergency measures by increasing short-term interest rates and halting its program of “quantitative easing (QE—which kept a lid on longer-term interest rates),” we will not be surprised if many global economies (including ours) go into a recession (or are already in one).

- The National Bureau of Economic Research (NBER), the quasi-official entity that declares when recessions start and stop in the U.S., uses a somewhat “squishy,” non-precise definition of recession as a “significant decline in economic activity that is spread across the economy and that lasts more than a few months.” A recession is often the cure for the disease of inflation. Investors have a visceral reaction to the “R-word,” so expect the media to try to continue trying to instill fear about an upcoming recession. We acknowledge the facts but need to stay clear from the fear mongering.

-

- Recessions are a normal part of the economic cycle.

- Every recession has been followed by an economic expansion. Every economic expansion has been preceded by a recession.

- The most recent recession was caused by the COVID-19 lockdown of the economy and was the worst since the Great Depression. While it was brutal (20.5 million jobs were lost, unemployment skyrocketed to 14.7% and gross domestic product plummeted 31.2% in Q2-2020), it was over in a relative blink of an eye due to massive monetary and fiscal stimulus.

- In past recessions, we usually suffer a significant increase in unemployment. But this time around, unemployment is quite low (3.6%) and companies are still trying to hire. Unemployment may increase, but given the current low levels, it is uncertain how much of a factor this would be to the overall economy.

- We are still writing the history of markets and economies. Though pundits and soothsayers make bold predictions with great confidence, the current economic backdrop is particularly tricky and we can assure you they don’t “know.”

Why Have a Disciplined Investment Approach?

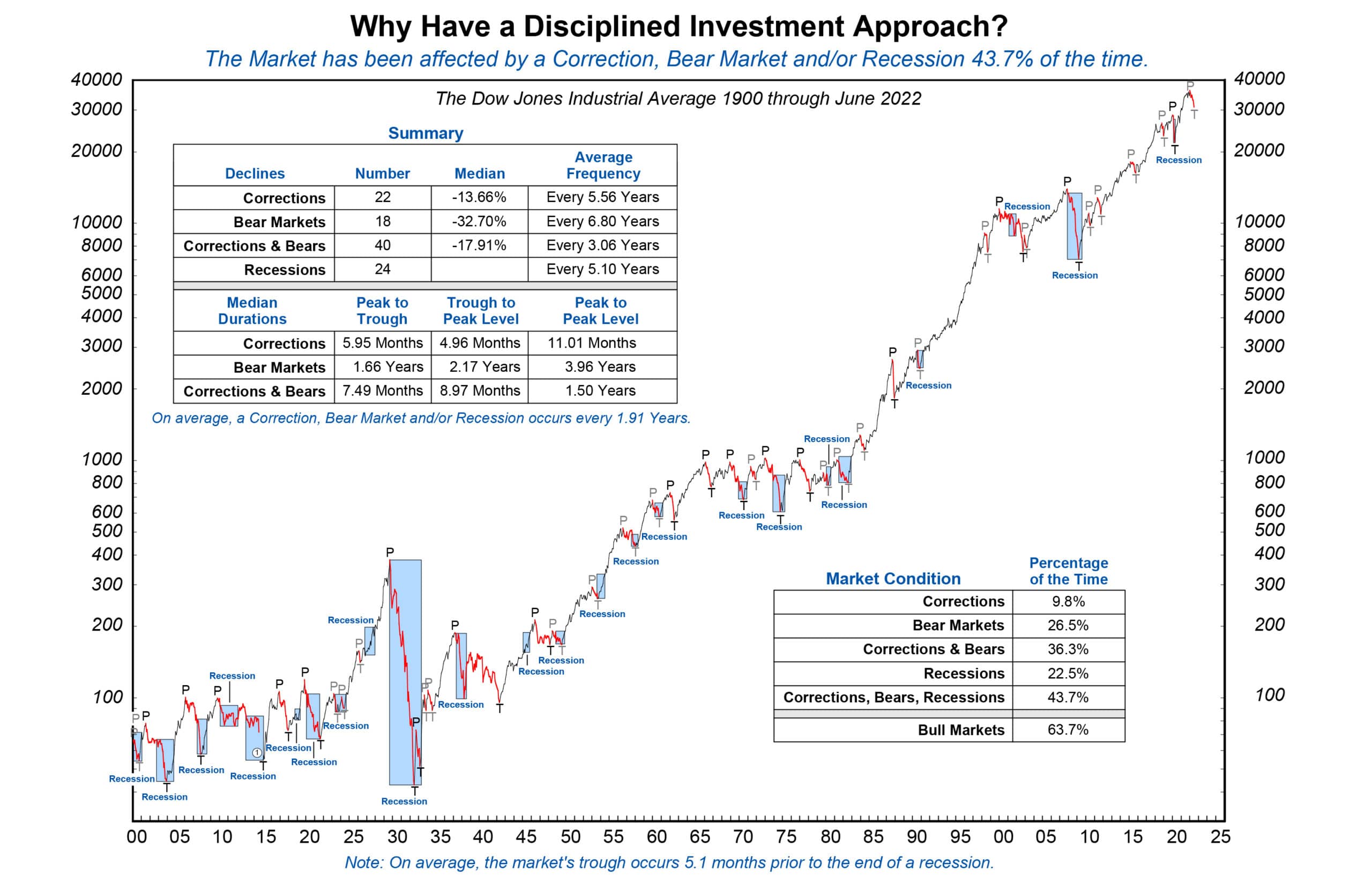

- As shown in the illustration from Crandall-Pierce (C-P), the stock market has been affected by a Correction (10%-19.9% drop), Bear Market (20%+ drop) or Recession almost half the time (43.7%).

- Related to the above, C-P calculated that if you invested $100 in the SPX on January 1, 1972 and stuck it in a drawer and forgot about it, on December 31, 2021 (50 years later) you would have had $4,668.61. If, however, you missed just the single best day in each of those fifty years, you would have had only $787.66, or 83% less. Over those fifty years, you would have had plenty of opportunities to “play it safe” and get scared out of the market. Just to name a few, you would have experienced:

- 20 Corrections

- 6 Bear Markets

- 7 Recessions

- Arab Oil Embargo (1973)

- Fall of Saigon (1975)

- Stock Market Crash (1987)

- Terrorist Attacks on World Trade Center and Pentagon (2001)

- Global Financial Crisis (2007-2008)

- COVID-19 (2020)

Looking Forward

- Anticipating what we may experience and how we may feel can help investors make better decisions. We should expect the media will promote every piece of negative news they can (fear sells). We should expect to get concerned and perhaps feel some fear about the future. It’s perfectly normal. In fact, the more we tune in to the media and look at account values, the more fear we can expect to feel. And the more fear we feel, the more we may be tempted to make a very unwise decision.

- We can also learn from history. Remember back to March of 2009. It was ultimate despair after going through over two years of a Global Financial Crisis with little hope things would improve. There was nothing positive to look forward to. And yet, that was when the market hit bottom. Since March 9, 2009, the SPX compounded at a whopping 16.1% annually (at that rate you double your money every 4.5 years) through June 30, 2022 (even with the current swoon). Those investors who stayed in the market reaped the benefit.

- During these times, the best thing to do is focus on what you control. You control your spending. You control what you pay attention to. You control your investment allocation, which was constructed with the expectation that recessions and bear markets will occur. While it can be uncomfortable to live through, none of this is unexpected nor outside the realm of what happens in healthy capital markets.

Summary

Past performance is no guarantee of future results, but you have a plan and investment strategy that has withstood numerous bear markets and crises. No investment strategy is immune to temporary losses. The real question is not what will the market do, but what will you do in response? Will you choose to exercise discipline, patience and indifference? We certainly hope so. That will put us in a position to weather the storm and potentially invest in high-quality companies whose stocks are on sale, which could ultimately reward you down the road.

KM Team Update

Associate Director of Client Service Maggie Kamman, CFP® and husband Kyle welcomed their second child, Brooks Dean, on June 13. Brooks and older brother Jackson are getting along famously and both are doing great. Congrats Maggie and Kyle!

Regards,

Kirr, Marbach & Company, LLC

Past performance is not a guarantee of future results.

The S&P 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This index cannot be invested in directly.

Subscribe

Subscribe to stay up to date with the latest news, articles and newsletters from Kirr Marbach.