Risk and failure indispensable to investment success

Mickey Kim and Roger Lee / May 3, 2024

We’ve all heard “no risk, no reward” or similar pearls of wisdom. While the assumption of risk is an indispensable part of successful investing and it seems intuitive the more risk you take, the greater the expected reward, the discussion is more nuanced.

Investing is sacrificing consumption today to consume more in the future. You have $100 and Object A costs $100/Unit. You can purchase/consume one Unit of Object A today or invest the $100 in hopes of being able to purchase/consume more than one Unit of Object A in the future (i.e. your investment time horizon).

At the very least, you’d like the $100 you invest today to be able to purchase/consume one Unit of Object A in the future. In other words, you want the $100 you invest to at least maintain its purchasing power between now and then.

Risk is the permanent loss of capital invested or loss of purchasing power from inflation. Investing in a company whose product becomes obsolete and goes out of business results in a permanent loss of capital. Investing with a 5% return when inflation is running 10% results in a loss of purchasing power (your investment grows to $105, but a Unit of Object A now costs $110).

Importantly, risk is not price volatility. Although stock prices are driven by fear and greed over the short-term and are very volatile, the value of the underlying businesses don’t change that much from day-to-day. If you’re correct in your assessment of the long-term value of the business, you shouldn’t be overly concerned about price volatility or temporary loss of capital. Indeed, volatility can either create an opportunity to buy or compel you to turn a temporary loss into a permanent loss by selling.

In his recent excellent memo, “The Indispensability of Risk,” Oaktree Co-Chairman Howard Marks wrote of the risk of not taking risk. “Because the future is inherently uncertain,” he wrote, “we usually have to choose between (a) avoiding risk and having little or no return, (b) taking a modest risk and settling for a commensurately modest return or (c) taking on a high degree of uncertainty in pursuit of substantial gain, but accepting the possibility of substantial permanent loss. Everyone would love a shot at earning big gains with little risk, but the “efficiency” of the market – meaning the fact that the other participants in the market aren’t dummies – usually precludes this possibility.”

Further, “most investors are capable of accomplishing “a” and most of “b.” The challenge in investing lies in the pursuit of some version of “c.” Earning high returns – in absolute terms or relative to other investors in a market – requires that you bear meaningful risk – either the possibility of loss in the pursuit of absolute gain or the possibility of underperformance in the pursuit of outperformance. In each case, the two are inseparable.”

“Not having any losers isn’t a useful goal,” Marks continued. “The only sure way to achieve that is by not taking any risk. But … risk avoidance is likely to result in return avoidance. There’s such a thing as the risk of taking too little risk. Most people understand this intellectually, but human nature makes it hard for many to accept the idea that the willingness to live with some losses is an essential ingredient in investment success.”

Investors must understand and even embrace the paradox failure is an essential element of success. According to Marks, “investors must accept that success is likely to stem from making a large number of investments, all of which you make because you expect them to succeed, but some portion of which you know won’t. You have to put it all out there. You have to take a shot. Not every effort will be rewarded with high returns, but hopefully enough will do so to produce success over the long term. That success will ultimately be a function of the ratio of winners to losers, and of the magnitude of the losses relative to the gains. But refusal to take risk in this process is unlikely to get you where you want to go.”

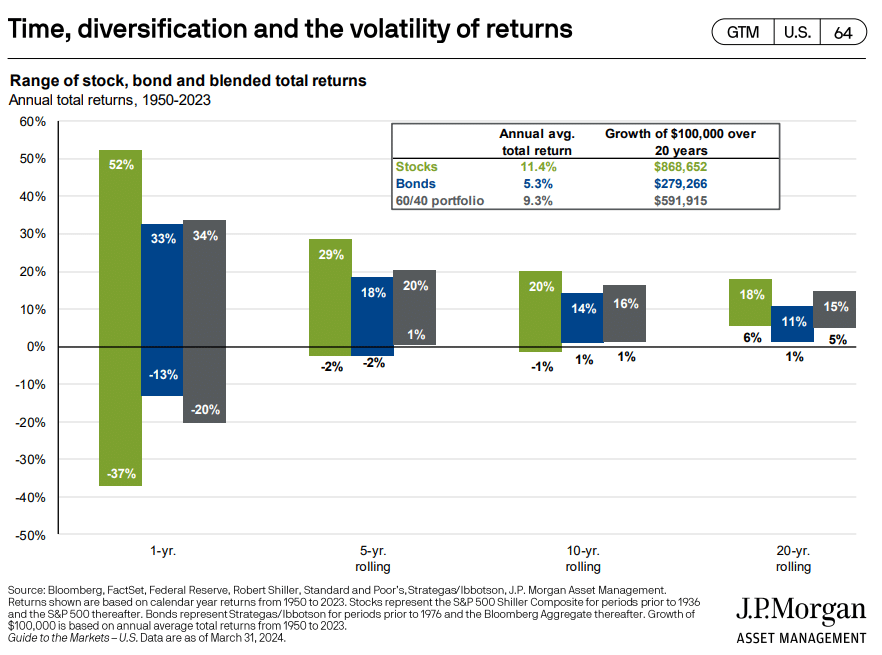

According to the illustration by J.P. Morgan Asset Management above, if you invested $100,000 in U.S. stocks at the beginning of 2003, by the end of 2023 it would have grown to $868,652. By contrast, the same $100,000 invested in U.S. bonds would have grown to only $279,266. Stocks had significantly more short-term volatility (1-year returns since 1950 ranged from 52% to -37%) than “safe” bonds (33% to -13%), but the long-term reward was having more than three times as much at the end. Past performance Is no guarantee of future results.

“YOLO” (“You Only Live Once”)/”FOMO” (“Fear of Missing Out”) speculative madness emerged in pandemic times, perhaps exemplified by “disruptive innovation” guru Cathie Wood’s ARK Investment Management. ARK posted spectacular returns in 2020 and into 2021. Sadly and predictably, returns-chasers piled on and ARK’s assets peaked at $59 billion in early 2021, making ARK the world’s largest ETF manager. Alas, the clock struck midnight for ARK, causing returns and assets to vanish.

According to Morningstar, as of the end of 2023 ARK had destroyed more wealth than any other investment manager over the prior decade, losing investors a collective $14.3 billion. Shareholders have abandoned ship and assets have shrunk to $11.1 billion.

Marks summed up the quest for superior investment returns, “you shouldn’t expect to make money without bearing risk, but you shouldn’t expect to make money just for taking risk. You have to sacrifice certainty, but it has to be done skillfully and intelligently and with emotion under control.”

The opinions expressed in these articles are those of the author as of the date the article was published. These opinions have not been updated or supplemented and may not reflect the author’s views today. The information provided in these articles are not intended to be a forecast of future events, a guarantee of future results and do not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular stock or other investment.