Fitch downgrade a warning U.S. approaching a financial reckoning

Mickey Kim and Roger Lee / August 18, 2023

A credit rating is used to predict the likelihood a borrower will repay its debts, on time and in full. Whether you’re an individual, company or a sovereign nation, a strong credit rating is treasure that must be guarded zealously. Your creditworthiness determines both your access to credit and the cost. The “riskier” you are considered as a borrower, the higher the interest rate a lender will demand to compensate for assuming your risk.

For individuals, your FICO (originally Fair, Isaac and Company) Score is based on data in your credit reports (issued primarily by Equifax, TransUnion and Experian) and used by lenders to help make credit decisions. Borrowers are categorized as “Exceptional” (800-850), “Very Good” (740-799), “Good” (670-739), “Fair” (580-669) or “Poor” (300-579).

S&P Global Ratings (S&P), Moody’s Investors Service (Moody’s) and Fitch Ratings (Fitch) are the three primary credit rating agencies (CRAs) for corporate and government borrowers. S&P’s and Fitch’s rating scale (strongest to weakest) is AAA/AA/A/BBB/BB/B/CCC/CC/C/D, with BBB- the cutoff between securities ranked “investment grade” and those considered “high-yield” or “junk.” Similarly, Moody’s rating scale is Aaa/Aa/A/Baa/Ba/B/Caa/Ca/C, with Baa3 the lowest “investment grade.” Clearly, the top tier is a very exclusive club with a small handful of members (U.S., Germany, Luxembourg, Netherlands, Sweden, Switzerland and Denmark). Unfortunately, the U.S. is well on its way to being kicked out of the club.

On August 1, Fitch downgraded its rating for the U.S. from AAA to AA+, saying its decision “reflects the expected fiscal deterioration over the next three years, a high and growing government debt burden and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

Fitch warned on May 24 its AAA rating for the U.S. was at risk as the June 1 “X-Date” on which the U.S. would default rapidly approached. This debt ceiling crisis was wholly man-made and was the result of unwillingness to pay, not inability to pay. Fitch lamented the recurring brinksmanship and wondered if a nation periodically contemplating not paying its debts was worthy of a AAA rating. As we now know, lawmakers narrowly avoided a default by suspending the debt ceiling until January 1, 2025. Unfortunately, Fitch had apparently seen this movie enough and decided to cut the rating anyway.

Mark Twain famously said, “history never repeats itself, but it does often rhyme.” Indeed, this was the second time in history the U.S. has been stripped of its top rating. On August 5, 2011, S&P cut its rating for the U.S. from AAA to AA+ (where it remains) following a debt ceiling standoff, stating “the effectiveness, stability and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges.” Sound familiar? Then, as now, critics of the downgrade pooh poohed it as “absurd” and “irrelevant.”

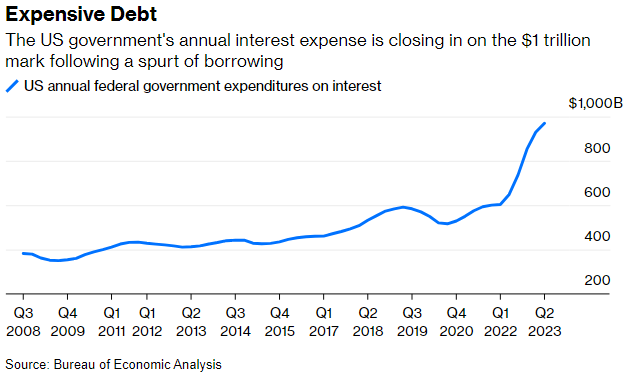

However, there are some important differences this time around. Twelve years ago, the Federal Reserve (Fed) was trying to stimulate an economy still recovering from the Global Financial Crisis and boost inflation up to its 2% target by implementing a “zero interest rate policy” (ZIRP) for short-term rates and buying bonds (Quantitative Easing) to lower longer-term rates. Borrowing was cheap and interest costs were about 2-4% of tax revenue. Starting in early 2022, the Fed slammed the brakes and reversed course to fight raging inflation, raising short-term interest rates from 0% to 5.5% and selling the bonds previously purchased (Quantitative Tightening).

The U.S. Treasury not only has to issue new debt at much higher interest rates to replace maturing debt, it has to issue more of it to fund the ever-increasing budget deficit. Our national debt stands at $32 trillion, 20% more than our annual Gross Domestic Product. The day before Fitch’s downgrade, Treasury boosted its estimated debt issuance by a third to $1 trillion for the July through September quarter. The combined result is annual interest costs are estimated to surge to a whopping $1 trillion, about 14% of tax revenue.

As government borrowing increases at the same time the Fed is selling its bond holdings, it “crowds out” private sector borrowing by making it more expensive. This hurts economic growth, which negatively impacts tax revenue, which causes deficits to increase, which have to be funded by issuing even more debt. Foreigners currently hold about $7.3 trillion or 31% of Treasuries outstanding, so it’s important they continue to buy to replace maturing debt. U.S. relations with China, the second largest foreign holder/creditor (behind Japan) holding almost $900 billion in Treasuries, are worsening, a risk few are talking about.

Both governments and households get deeper in debt when spending exceeds income. Reversing this trend would require generating budget surpluses by cutting spending and/or raising taxes, but there is currently no political will for material changes. Fitch’s downgrade is a stern reminder our fiscal house is not in order, so fasten your seatbelts as we hurtle towards an increasingly likely government shutdown on October 1.

The opinions expressed in these articles are those of the author as of the date the article was published. These opinions have not been updated or supplemented and may not reflect the author’s views today. The information provided in these articles are not intended to be a forecast of future events, a guarantee of future results and do not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular stock or other investment.