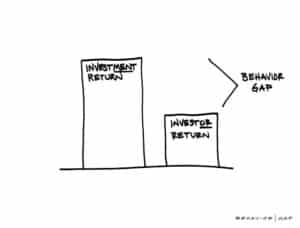

Study shows “behavior gap” continues to destroy investor returns

Mickey Kim / August 16, 2019

We clearly can’t control trade wars, the markets or White House tweets, but our behavior is up to us.

Suppose you got spooked last December and sold your stocks as the market’s collapse reached a crescendo on Christmas Eve. Who could blame you, with the talking heads screaming about the “Worst December Since the Great Depression” and the “Worst Year Since the Global Financial Crisis”?

Perhaps you eased your pain over the holidays by telling yourself you’d jump back in the market once the bleeding stopped. That sounds like a reasonable strategy, but if you sat on your hands even a few days, you missed the “Best January for Stocks in 30 Years” and did yourself great financial harm.

Unfortunately, investors have an uncanny, destructive tendency to buy high (when they’re feeling (over)confident) and sell low (when they’re scared).

That’s the message from DALBAR’s 25th annual Quantitative Analysis of Investor Behavior (QAIB) report, which measures the effects of investor decisions to buy, sell and switch into and out of mutual funds. The effects are measured from the perspective of the investor, not the investments themselves, and show the average investor earns less (often much less) than fund performance reports would suggest.

According to DALBAR, “investor behavior is not simply buying and selling at the wrong time, it is the psychological traps, triggers and misconceptions that cause investors to act irrationally.” The report identified nine harmful behaviors, most importantly:

- Loss aversion. Behavioral economists have shown the emotional pain of a loss is about twice the pleasure of a gain of the same amount. So, negative experiences will “weigh more heavily and for a longer period of time and be what predominately shapes the investor’s behavior.” Investors must fight their natural urge to panic and flea when stocks hit an inevitable rough patch.

- Availability bias. Investors’ most recent experiences will have the most profound effect on their behavior, which is why things tend to go to extremes. During the technology bubble of the late 1990s, investors’ recent experiences led them to see future gains as “being irrationally more probable,” perhaps like today’s “FAANG” stocks.

Successful “market timing” (i.e. jumping into and out of stocks) is an expensive fantasy. If you’re going to have long-term success, you have to ride out the bad days to benefit from the good days.

J.P. Morgan assumed a $10,000 initial investment in the S&P 500 Index (SPX) for the 20-years ending December 31, 2018 to determine the cost of missing the best days. Importantly, six of the 10 best days occurred within two weeks of the 10 worst days. As you can see, missing just the 10 best days in the 20 years cut your return in half and you actually lost money if you missed the 20 best days.

| January 1, 1999 to December 31, 2018 | $ Ending | % Annualized |

| S&P 500 Index (Fully Invested) | $29,845 | 5.62% |

| Missed 10 Best Days | $14,895 | 2.01% |

| Missed 20 Best Days | $9,359 | -0.33% |

| Missed 60 Best Days | $2,144 | -7.41% |

Crandall, Pierce looked at the market timing issue a little differently, assuming you missed the single best day in each year for various periods. Assuming you made the same $10,000 investment in the SPX on January 1, 1969, stuck it in a drawer and forgot about it, you would have had $241,368 on December 31, 2018. If instead you tried to “time the market” and missed just the single best day in each of those 50 years, you’d have less than a fifth of that amount.

| Periods ending December 31, 2018 | 10-Years (2009-2018) |

15-Years (2004-2018) |

25-Years (1994-2018) |

50-Years (1969-2018) |

| S&P 500 (Fully Invested – $) | $27,754 | $22,545 | $53,743 | $241,368 |

| S&P 500 (Fully Invested – % Annualized) | 10.7% | 5.6% | 7.0% | 6.6% |

| Less Best Day Each Year ($) | $19,443 | $12,990 | $21,194 | $42,599 |

| Less Best Day Each Year (% Annualized) | 6.9% | 1.8% | 3.1% | 2.9% |

My friend Carl Richards, CFP coined the term “behavior gap” to label the shortfall between investor returns and investment returns that occurs because rising prices attract us and falling prices scare us. Instead, take your cue from Warren Buffett, who said “lethargy bordering on sloth remains the cornerstone of our investment style.”

The opinions expressed in these articles are those of the author as of the date the article was published. These opinions have not been updated or supplemented and may not reflect the author’s views today. The information provided in these articles does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular stock or other investment.

Subscribe

Subscribe to stay up to date with the latest news, articles and newsletters from Kirr Marbach.